- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

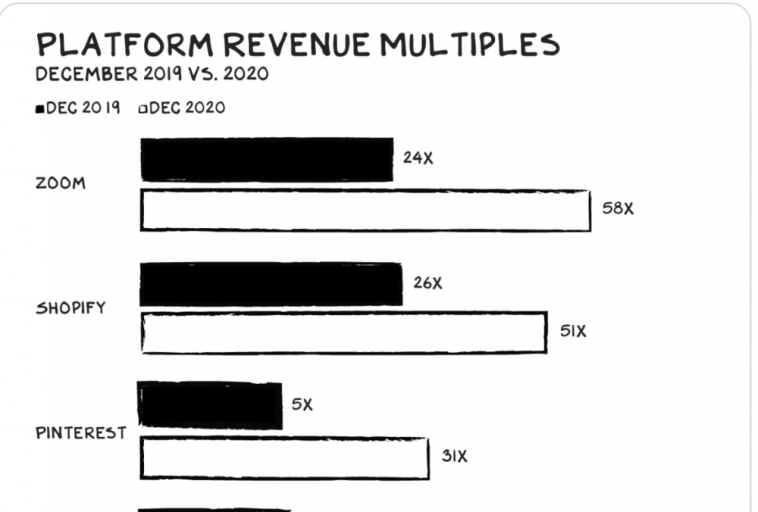

So as you’ve seen, acquisitions have picked up in SaaS. Slack was acquired for $27B — that’s 27x its $1B in ARR. Zoom and Shopify trade at even higher multiples:

And yet, here’s the thing. So many acquisitions, so many IPOs, so many public and private valuations of great SaaS companies are actually at / worth less than 10x ARR.

Let’s take a look at a few recent examples:

- Pluralsight was just acquired for $3.5B by Vista. Amazing! But … that’s on $400m+ of ARR, growing 20% Year-over-Year. We can assume that’s about 8.5x ARR or so, plus or minus — after a 25% premium in the deal. That’s for a market leader in training.

- Apptus acquired Conga for $715m, the last of our Class of ’06 to get to $100m ARR (not a new deal, but I’d missed it). Again, an incredible outcome. But less than 7x ARR. Now, the combined company likely will pull off a great IPO soon and everyone will make a lot of money. But still, that’s 7x ARR for a market leader in document creation.

- Social news and media leader Meltwater IPO’d at a $1.4B valuation — on a $300m+ run rate. Again a great leader, trading at 4x-5x ARR.

- And ahem … even Salesforce itself only trades at about 9x ARR.

And let’s take a look at the 15 SaaS leaders with the lowest ARR multiples in the BVP Nasdaq Index:

You can see that leaders from Box to Zuora to Dropbox to SurveyMonkey and more all trade for well under 5x-10x ARR. Now, to be clear, the ones that do trade in the lower multiples have lower growth. Generally, less than 25% a year after $100m+ in ARR.

And there also are odd exceptions. Adobe has had an incredible run, but growth has slowed to 20%, and it still trading at 18x ARR. ServiceNow seems high at 22x, despite incredible execution.

Just a few take-aways from all this:

- Crazy multiples are attached to crazy growth, or at least, the expectations of it. So if you go out looking for 20x, 30x, 100x ARR … understand that’s what you are signing up for.

- Don’t expect the next round to be doable if growth slows. This has always been true, but even more so today. If you don’t hit the growth expectations for a round, most VCs aren’t going to be asking for their money back. But assume the next round will be much harder to raise in an environment where everyone is expecting insane growth.

- M&A prices look like on TechCrunch — but actually are all over the place. Yes, if the acquisition is strategic, multiples are at all-time highs. But PE multiples seem to in many cases have almost come down as ARR multiples.

- Growth has always been King+Queen, but especially now. Once you fall out of it, you have to find your way back. Don’t waste your limited capital on low ROI initiatives. But it’s worth it to make the hires you need for next year now. Keep that engine running at its maximum efficiency, especially now.

- Think of 100% growth / 120% MRR / at $10m ARR as the minimum bar to raise VC. This probably has been true for a while, but especially today. This is the minimum bar for venture financing. So you have to be growing faster than this prior to $10m ARR, and ideally, even at $20m+ ARR growing 100% YoY still.

- Be careful about advice to “go raise now while times are good” if you don’t meet the bar. VCs will just tune you out if you don’t meet the growth and NRR bar. Ask your existing investors if you really have the metrics to raise right now.

- If you fall out of hyper-growth mode, still go long. That will bail you out. If your net churn is negative, you have a superpower. As long as you are growing even 60% a year, you can still compound into something amazing over a decade. Even if there is a stretch you are unfundable.

Yes, these are the Best of Times in Cloud. With the Cloud being bigger than ever, the leaders in SaaS are growing faster than ever. So they probably deserve multiples of 25x-50x ARR.

But if you aren’t the next Shopify or Slack, you might not be worth 10x ARR. Even if you are doing just fine. Just keep that in mind.