- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Jamin Bell of Altimeter Capital has a great Substack looking a lot of SaaS and Cloud metrics. I thought I’d pull out one set of data and focus on what it means for startup valuations.

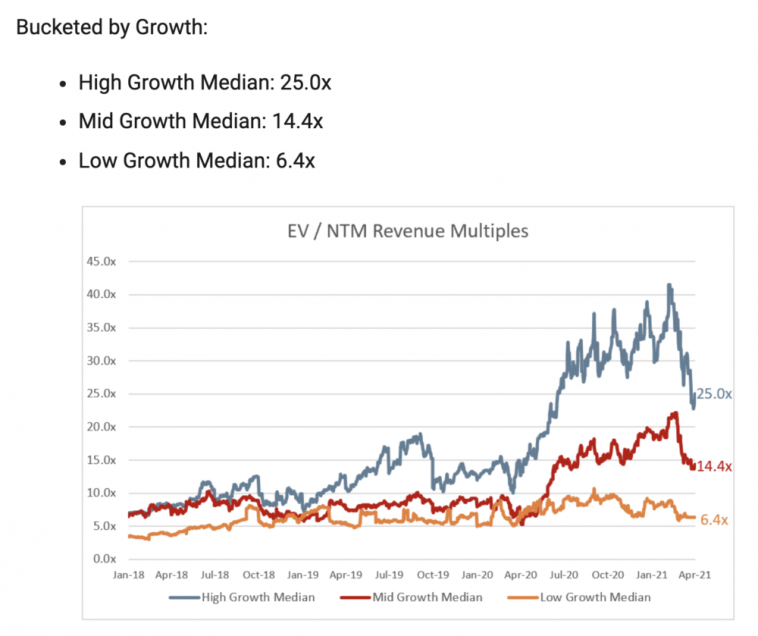

First, what are public SaaS companies worth today (after a modest pull back?)

Since these are all public companies, they are all by definition Great SaaS Companies. And the ones growing > 30% year-over-year post IPO (what it takes to remain a growth company) are worth a stunning 25x next year’s revenues. The ones were pretty good growth are worth 15 next year’s revenues. And the ones that are < 15% growth are worth 6x next year’s revenue on average (and in many cases, less).

That turns out to be just about true for start-ups, as well. It’s just the growth rates are different.

The anchor growth rate post-IPO for a SaaS company is 30%+ Year-over-Year growth (at $150m+ ARR). Do that, and you are a growth stock with a high revenue multiple. Fall below 30% growth post-IPO though, and your multiple plummets. Below 20% and you become a highly mature stock, with low revenue multiples, no matter how successful the product is.

The anchor growth rate for a SaaS startup remains, roughly, the Triple Triple Double Double. I.e., go at least from $1m to $3m ARR in one year, then $3m to $9m, then $9m to $18m, etc. I.e., the top SaaS companies still at least triple annually before $10m ARR, and at least double thereafter.

Now these days, the very very top SaaS companies can do even better. See Zoom, UiPath, Snowflake, Datadog and more. So when a VC thinks they see one of these, the valuations can seem almost nonsensical, e.g. 100x revenues.

But generally speaking, the above yardsticks are about right:

- Growing Way Faster Than Triple Triple Double Double? You might be worth 25x next year’s revenues. If you are growing very quickly, you can see how this can back into a very high multiple of this year’s revenues / current ARR.

- Growing Triple Triple Double Double? You might be worth 15x next year’s revenues.

- Not Growing Triple Triple Double Double, but growth is OK? Here, it gets tougher. You probably aren’t fundable. But 6x next year’s revenues is a good yardstick.

The biggest froth in startup markets is how few SaaS and Cloud companies really command the top-tier revenue multiple of 25x+. But how many private Unicorns do. Can they all grow as fast as Datadog, Shopify, Snowflake, and more at scale? We’ll see. That’s the best VCs are making. That there will be 500 more of these top-tier public SaaS companies.

Public company and startup revenues don’t tie perfectly, but they usually are in sync.