- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

So Domo is an interesting case study on SaaS entrepreneurship. Founder Josh James had one of the earliest $1B+ exits in SaaS when Adobe bought his first start-up, Omniture, for $1.8 Billion way back in 2008. Omniture, now Adobe Analytics, is still big and it dominated web analytics, especially for bigger companies in the earlier days of the internet.

After a less-than-fun time being acquired, he came back and founded a next-generation enterprise analytics company, Domo. It launched in a much more competitive environment but still grew quickly and IPO’d back in 2018. After decades running SaaS companies, it was time for a break in 2022, and Josh eventually stepped down as CEO.

But then … things slowed down, to 5% a year at $360 million in ARR.

So in 2023, Josh came back as CEO again to return the company to growth.

5 Interesting Learnings:

#1. Josh is Spending a Ton of Time on the Road With Customers to Get Back to Growth.

This is how you do it, folks

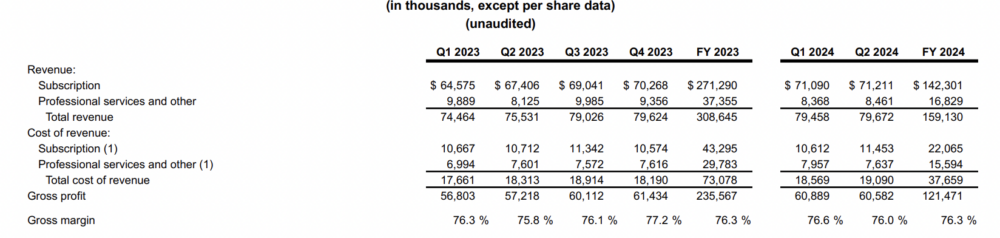

#2. They Don’t Lose Money on Professional Services.

It’s always an interesting challenge on how to monetize professional services in enterprise SaaS companies. Some see them as a loss leader, and some actually make money on them. Domo makes a bit of money on services — only 10%, but by charging more than they cost to provide, they keep their blended gross margins at a healthy 76%

#3. Moving From Per-Seat Pricing to Consumption-Based Pricing, and See a Revenue Lift from It

The analytics space has mixed models here, but Domo is moving to consumption-based pricing in part to ensure every employee at a customer that can use Domo, does use it. So far, it seems to be working. 60% more users log-in to accounts with consumption-based pricing, and 50% of new customers are choosing consumption-based pricing.

#4. Still Structuring Consumption-Based Deals as Subscription Contracts, Smoothing Out the Revenue

In a slower-growth environment, this can help make sure lower usage doesn’t dramatically drag down a quarter.

#5. 30% of the Sales Team Churned in 2022. Much Lower So Far in 2023.

Whether this is due to macro changes, or the return of a charismatic founder, I don’t know. But interesting to see it called out.

And a few other interesting learnings:

#6. 67% of Customers on Multi-Year Contracts, And Going Up,

This certainly helps slow down churn, even if it really just masks it in the end.

#7. GRR Just Under 90%, NRR Just Under 100%.

Domo’s logo retention is pretty good, but it’s struggling on the upsell and to grow accounts. NRR of under 100% is some of the lowest in the enterprise. But GRR isn’t.

#8. “Free” Competition and Vendor Consolidation One Of Their Biggest Challenges Today

We’re seeing this with many SaaS vendors. Domo is seeing some of its customers not renewing due to a broader BI tool they also have that may not have Domo’s functionality, but where analytics are included. This is one of the biggest ways IT departments are moderating SaaS spend today, and while it doesn’t hit everyone, it’s hitting Domo. And others. Vendor consolidation is a big theme for Domo.

#9. Not Seeing Any Macro Improvements Yet

Some are, some aren’t. Domo is still seeing CIO level cuts.

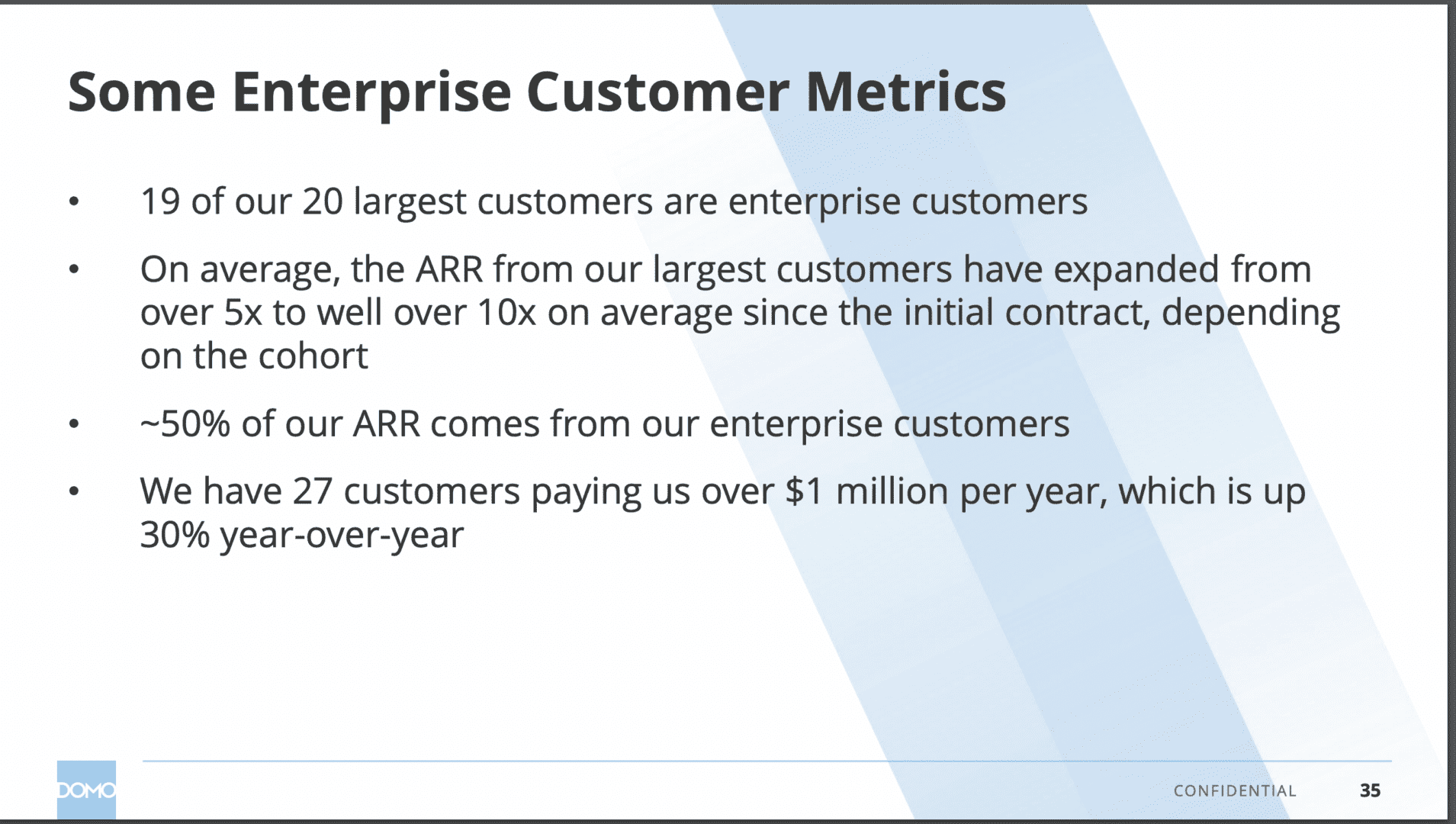

#10. Sells to Mid-Market and Enterprise, But Going More and More Enterprise. 50% of Revenue and Have 27+ $1m Customers.

They’ve seen more stability in the enterprise, albeit with tough direct competition, and lots of pricing pressure from them.