- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

We’re approaching the age of 1,000+ Unicorns and despite a global pandemic, this remains The Best of TImes in Cloud and startups in general.

But there’s a quiet cautionary tale to just think about. The two latest $1b+ acquisitions weren’t quite as glamorous as they seem:

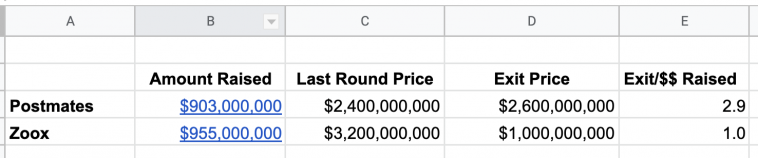

- Uber acquires Postmates for $2.6b

- Amazon acquires Zoox for $1b

Both sale prices amazing and both have incredible and inspirational CEOs leading them. And personally, I love Postmates as a product.

And yet, look at how much they raised and their last round valuations:

The lesson, such as it is? These are incredible companies with incredible teams each with a unicorn “exit”. And yet, neither really met the bar of selling for 10x the total amount you raised, and/or 3x the last round price.

The lesson is just that the stakes really do go up with each round, that’s all. In Postmates, the early investors still made a ton of money, as would some employees. In Zoox, it’s possible very few investors or employees made any money at all.

So raise what you need. In fact, raise 25% more than you need. You always need that extra 25%. At least as a buffer.

And raise to win.

Just remember, when you do raise, it’s not all fun and games. You’re committing to returning 10x the overall amount of capital you take in. So when you raise a $2m seed, you are committing to a $20m+ exit. And when you raise a $15m+ Series A? That’s a $200m+ exit you are committing to, really. And raise $25m-$30m or more, in a hot round?

You’ve almost signed up for an IPO really. Or almost a billion+ acquisition. Or at least, an exit 3x the price of the round you just closed.

Just know what you are signing up for, that’s all.

Published on July 7, 2020