- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

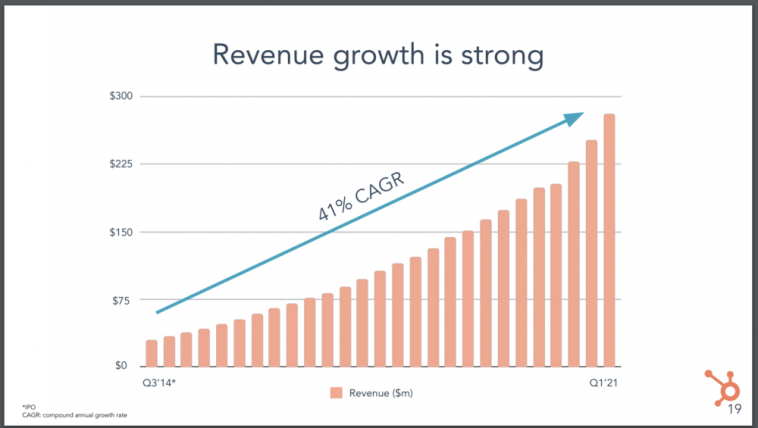

Hubspot didn't just grow an incredible 41% in Q1'21 to $1.1B in ARR

It accelerated

* Revenue growth accelerated from 32% to 41%

* And new customer growth accelerated to a crazy 45% YoY

* All while keeping ACVs constant at ~10kThey did it the hard way, with SMBs

— Jason ✨BeKind✨ Lemkin ⚫️ (@jasonlk) May 6, 2021

We last checked in with HubSpot as they crossed $1B ARR, and ordinarily, it would be a little quick to check back in.

But the latest quarter is very interesting. Why? HubSpot is sort a bell-weather stock and company for selling to SMBs and mid-market.

And what we see is that SMB is on fire in SaaS.

- At $1B ARR, HubSpot was growing at 32% year-over-year.

- And now — just a quarter later, it’s growing 41%. Wow.

Yup HubSpot is now growing a stunning 41% at $1.1B ARR, and has raised guidance to $1.3B for the full fiscal year, up from $1.17B.

And this isn’t 41% growing leveraging say 130% NRR. Now, it’s the harder way — on top of 100% NRR from mostly SMBs. Without the huge NRR boost from the existing base you get in more enterprise SaaS.

A few other interesting learnings:

#2. International Revenue is now 45% of all revenue, up from 22% at IPO. Going global really does help.

#3. Word-of-mouth remains the source of 33% of their new customers. And the #1 source. A reminder of what really helps the top software companies grow — and always has.

#4. HubSpot keeps adding new core products to fuel growth. This has been a top theme in our 5 Interesting Learnings series. SaaS companies that continue to grow at top quartile rates after $100m ARR add another core product or two. HubSpot is doing it again with Operations:

Interestingly, as we noted in our prior look at HubSpot, it’s adding more value and products for the same ACV. More value for the same average $10k per year. Average revenue per customer is basically flat at $9,886, down a nominal 1% over the year-ago quarter.

#5. Customer count up 45% to 113,925. Customer count is growing even faster than revenue. This is perhaps the biggest takeaway at all. HubSpot is adding a breathtaking number of SMB customers at $1.1B in ARR. Even though SMBs often at best have 100% NRR, HubSpot is more than making up for it with 45% annualize customer growth. That’s crazy.

And it shows the Best of Times for SMB SaaS have only just begun.