- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Q: How should shares in a startup be divided between 4 co-founders? If we have equal shares, what if one of us puts in a cash injection at a later date?

You’ve got two good, different questions here.

Question #1: How should you divide shares up between 4 co-founders?

- First, whatever you do, make sure the shares vest — for all of you. 4 co-founders is a lot, and it’s likely 1 of you will leave. Make sure it’s fair to the rest. 4–5 year, or ideally longer, protects the most committed. A bit more on that here: A Simple Commitment Test For You And Your Co-Founders | SaaStr

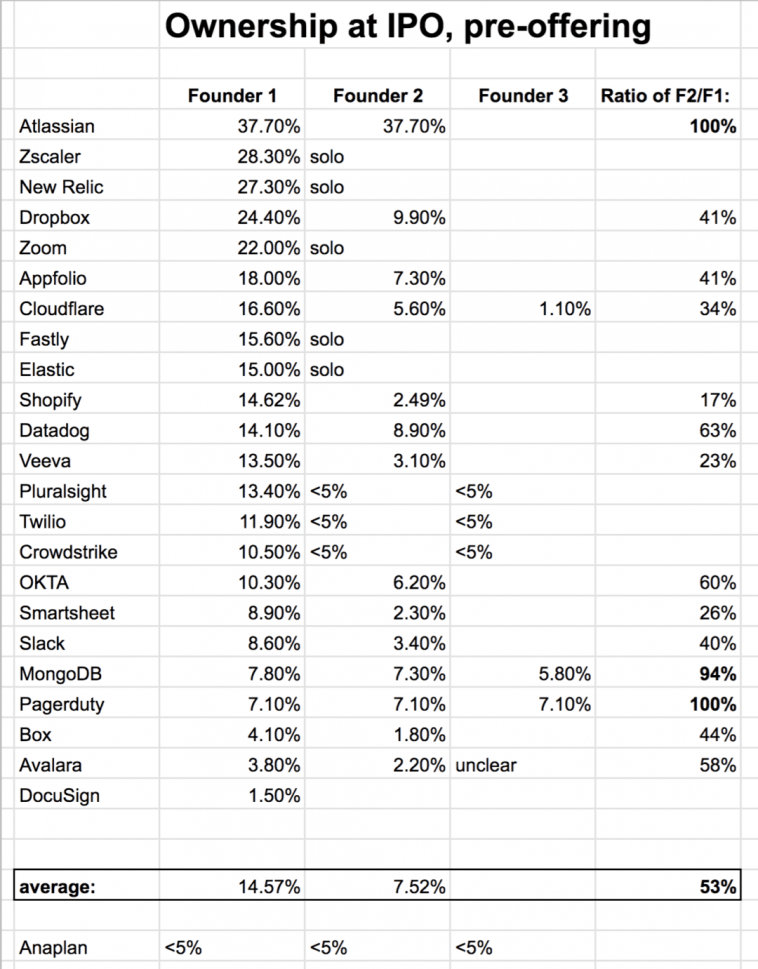

- Second, the ratios just need to be fair. Usually with 4 co-founders, 1 or 2 are doing more, or adding more value. If so, a 2:1 or 3:1 ratio is common for their shares. If everyone really is equal, you can make all shares equal. A bit more here: At the Top SaaS Companies, Founder-CEOs Own ~15% at IPO. And Most Co-Founders Are Not Equal (And That’s OK). | SaaStr

Here are the founder equity ratios at a bunch of SaaS and cloud leaders:

OK, now what if in the early days, one founder puts in a cash injection?

- The simplest thing is to pick a low & fair price for the shares — and issue them more shares. E.g., you could pick at $2m nominal valuation, and if they inject $50k and the others don’t, they’d buy 2.5% more of the company. This is fair.

- Less common is treating the cash injection as a loan, that you pay back when you can. But if it’s pretty small, this can be simpler. I’ve done both routes myself.

How to Divide Up Founders’ Shares originally appeared on SaaStr.com