- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

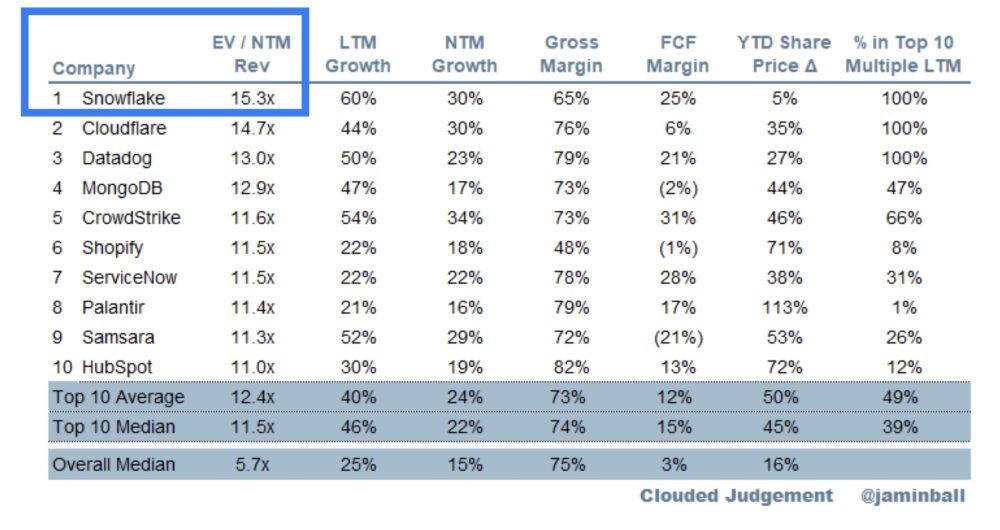

So Snowflake is the high flier in Cloud. It’s one of the few still commanding a premium multiple in today’s world, and still growing at tremendous rates:

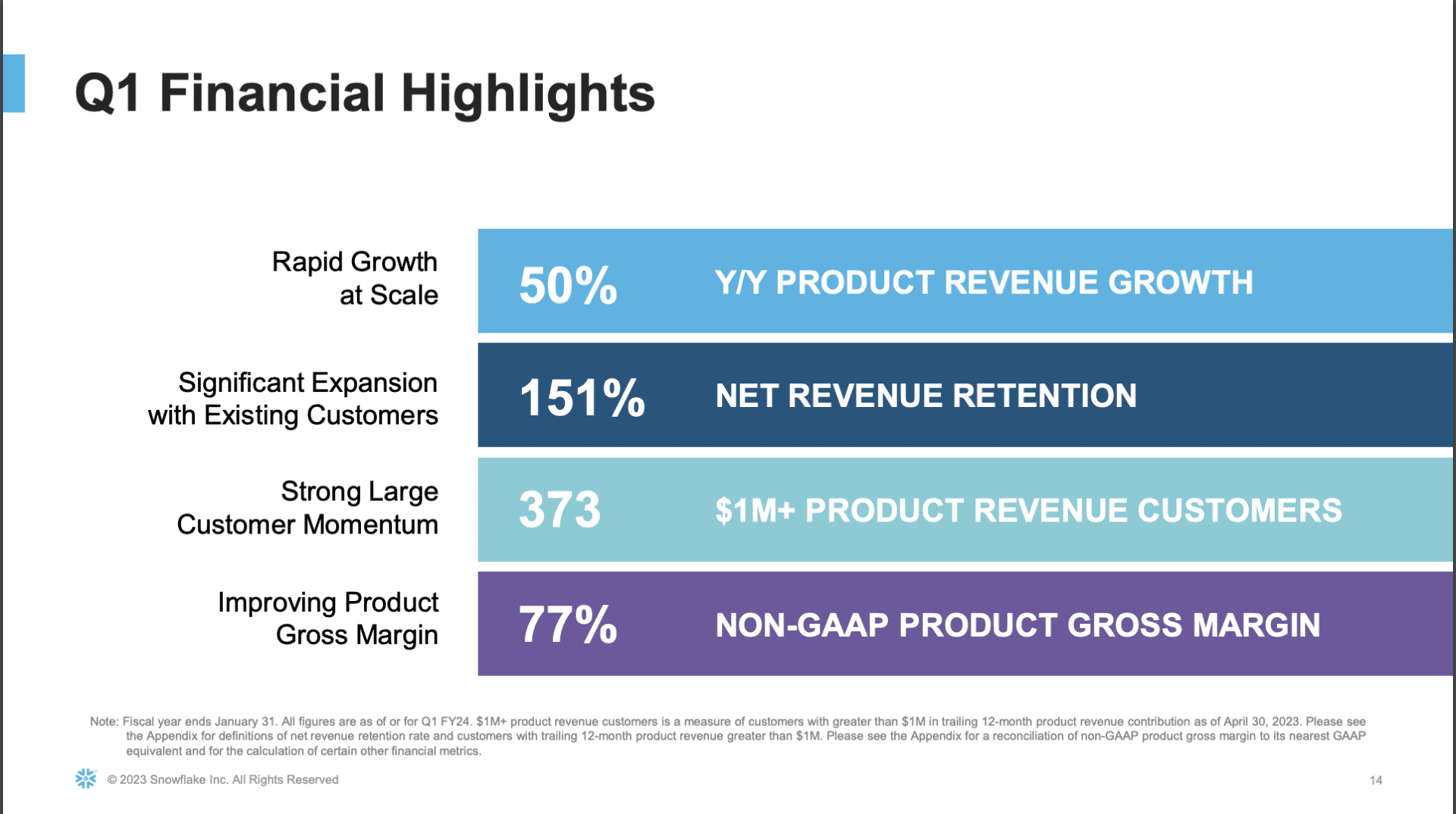

Snowflake is also a barometer of everything in SaaS and Cloud, because a significant amount of its revenue is consumption-based, at least in part. So when CFOs and others tighten budgets, they’ll also try to buy less Snowflake. Not none, just less. AWS is seeing this, and so is Snowflake. Growing remains jaw-dropping at 50% at $2.4 Billion in ARR, but customers are trying to reduce their spend or at least slow the increase in spend. Which just makes sense.

5 Interesting Learnings:

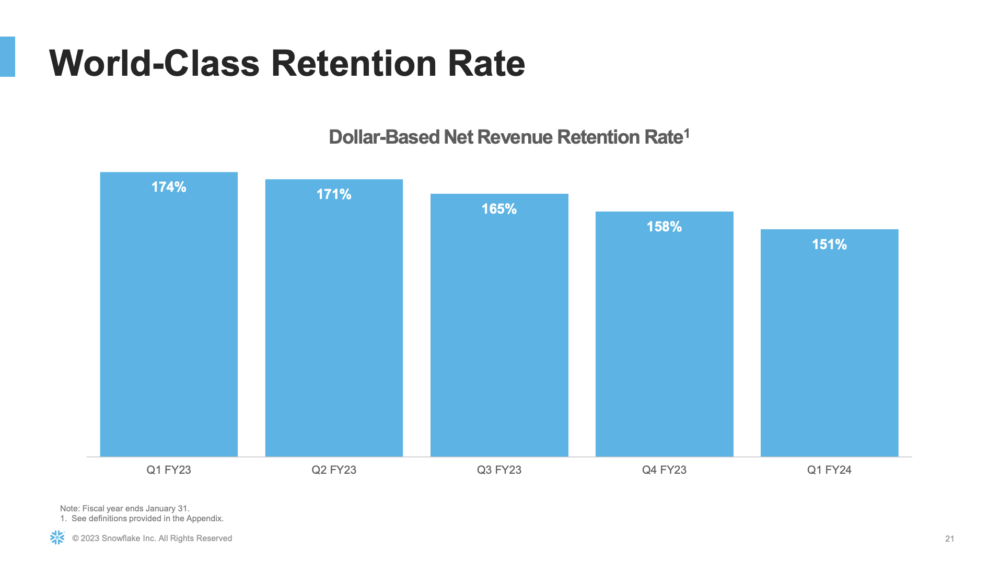

#1. NRR Remains Strong at 150%, but Down From 170%+ a Year Ago. More evidence of customers, especially big customers, trying to control spend more aggressively. 150% NRR is still top decile. But it’s down from the almost crazy 170% of the past few years. And from even just a year ago.

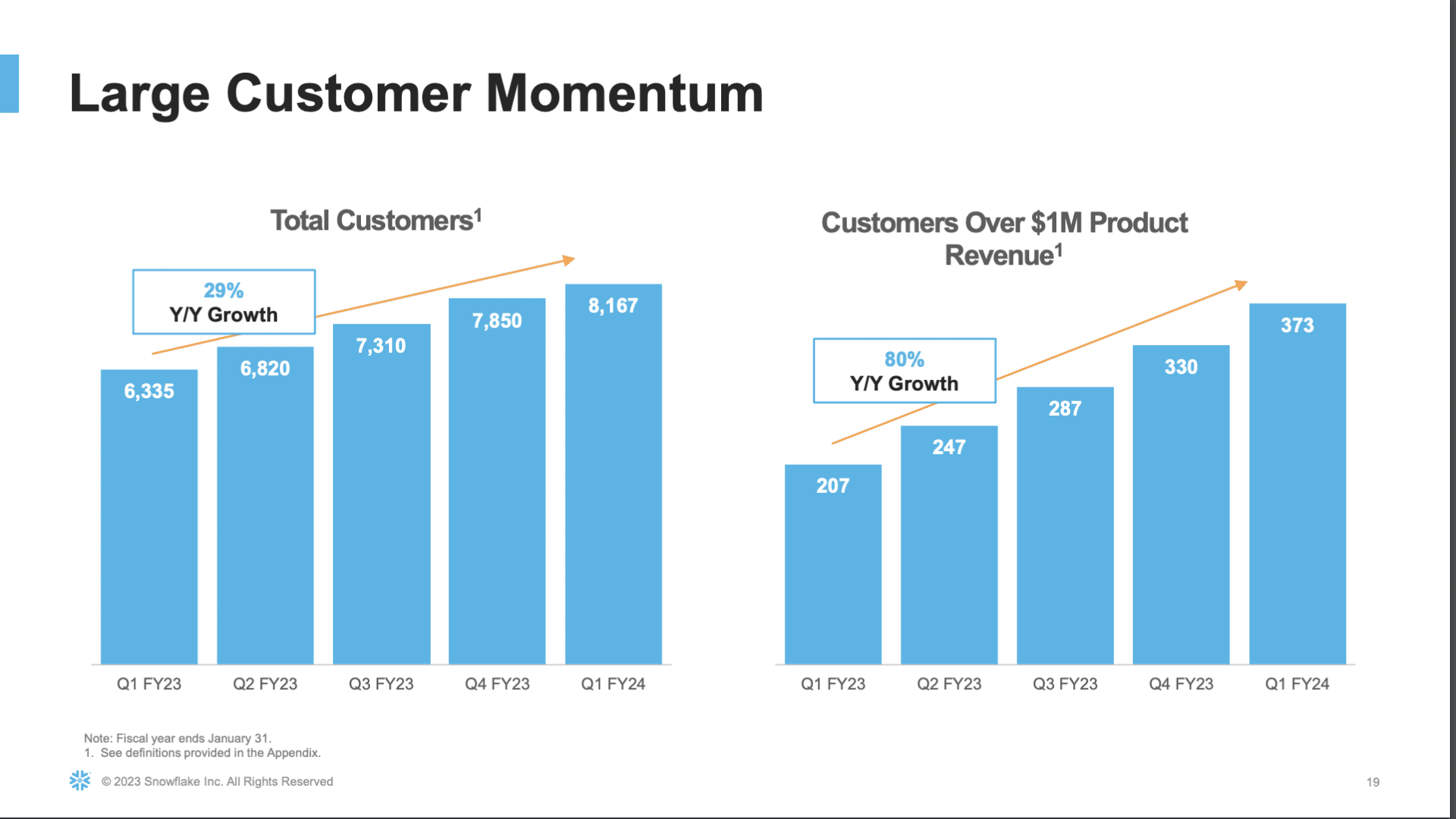

#2. It’s Almost 400 $1M+ Customers Fuel Growth — They Are Growing 80%. Overall customer growth is 29%, pretty impressive at $2.4 Billion in ARR. But it’s the $1M+ ones that are fueling the big numbers at this scale. They are growing 80%.

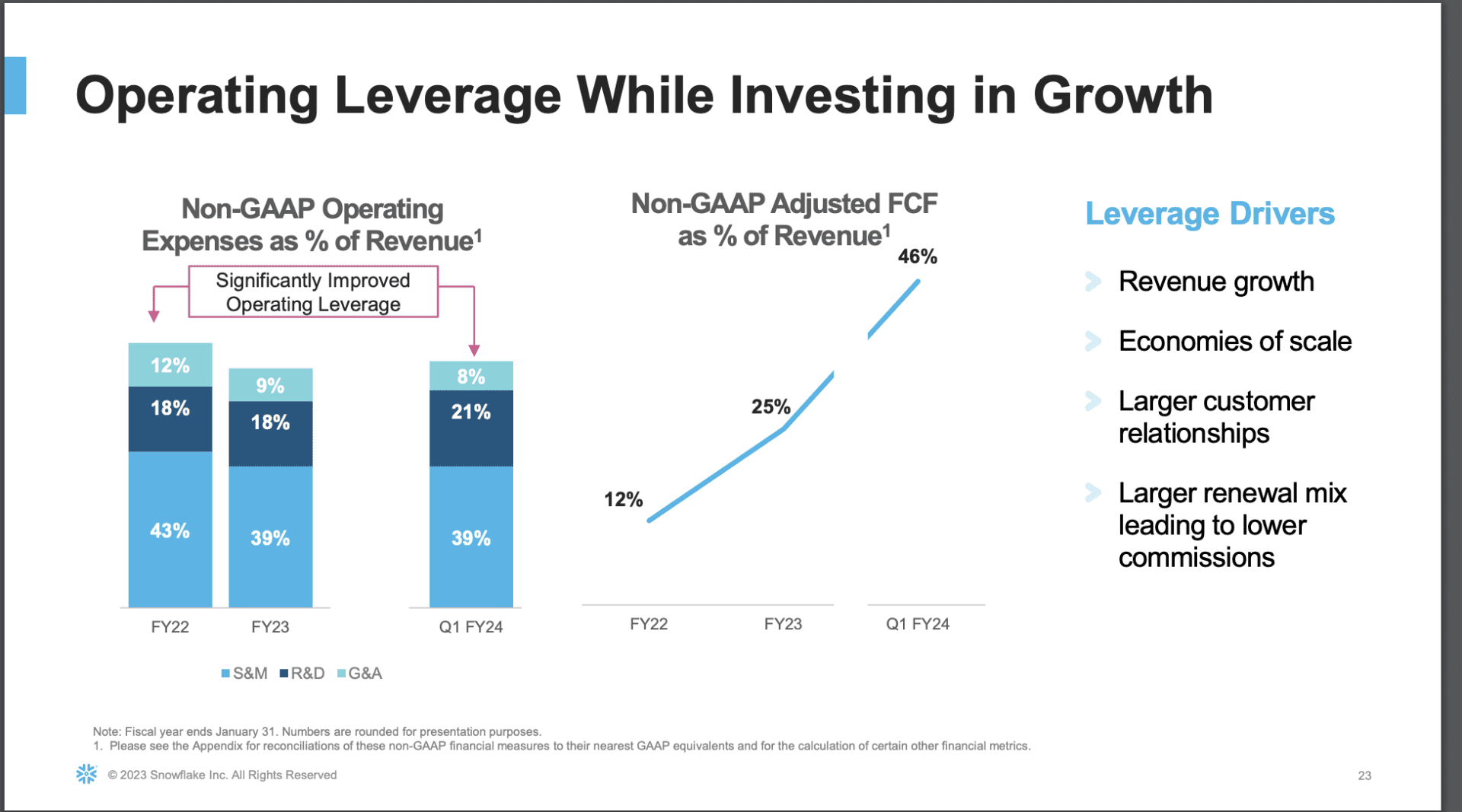

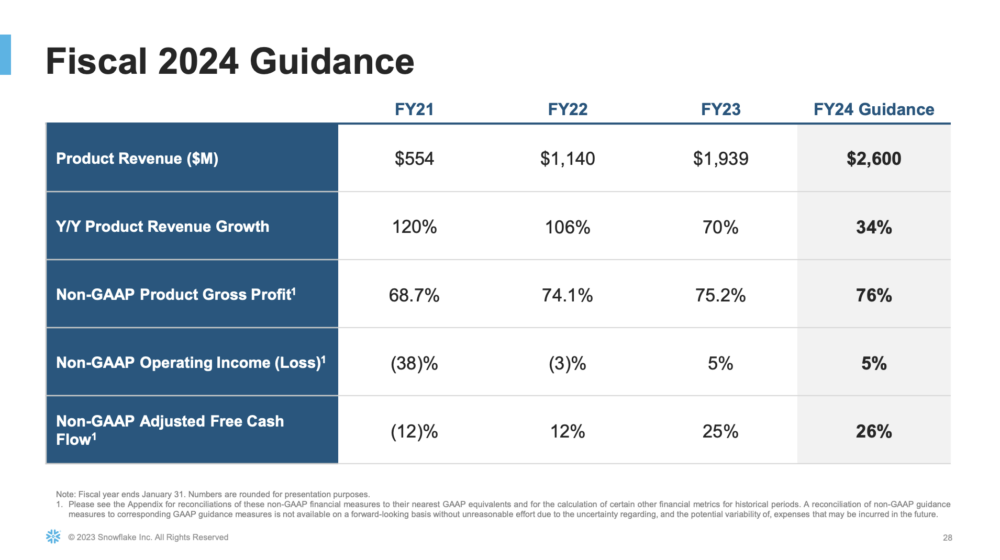

#3. Getting Radically More Efficient, With Non-Gaap Free Cash Flow Doubling from 12% to 25% of Revenue. This is the theme of the day. Almost every Cloud and SaaS leader is getting radically more efficient, including Snowflake. Not only has its free-cash flow doubled in just one year from 12% to 25%, but it’s predicting epic free cash flow in 2024 of 46%. Wow. Everyone is basically doing more with not much more headcount (see next point).

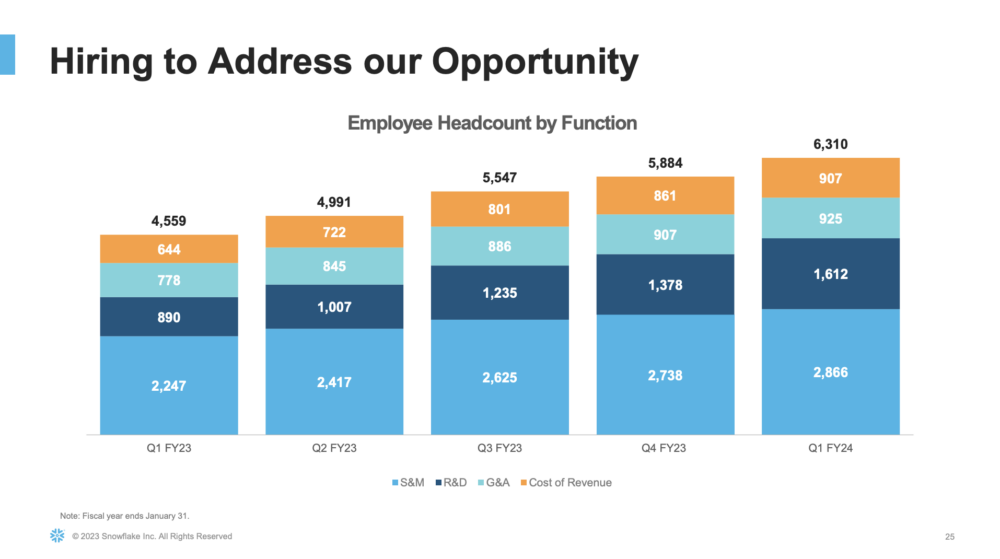

#4. Growing Headcount, But Much More Slowly That Revenue. Headcount is up 29% year-over-year, but revenue is up 50%. This is how you get more efficient. Also you can see sales & marketing headcount is basically flat, while hiring is almost all in engineering / R&D. We see a very similar story at other cloud and SaaS leaders, too.

#5. Predicting a Conservative 36% Growth in 2024. This is perhaps the biggest take-away, along with radical efficiency. Snowflake is being cautious for next year — and they know. They see the data in real time in terms of usage. They’re modelling “only” 34% growth for next year. Still incredible at their scale, but materially slower than this year and much slower than the preceding years.

And a few other interesting learnings:

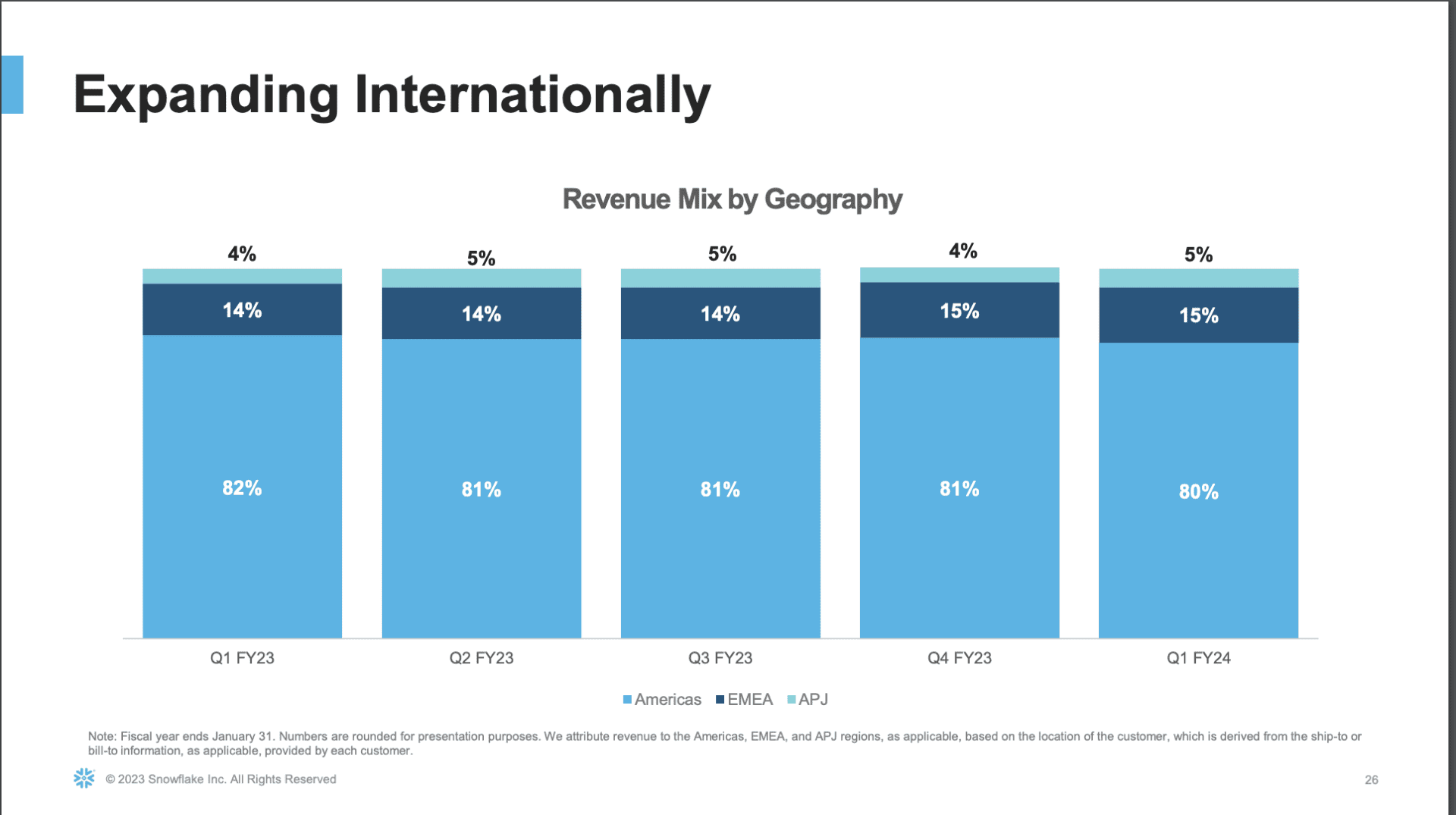

#5. Slowly But Surely Expanding Outside of North America. 80% of Snowflake’s revenue is still in North America. But that’s slowly coming down as international ramps up.

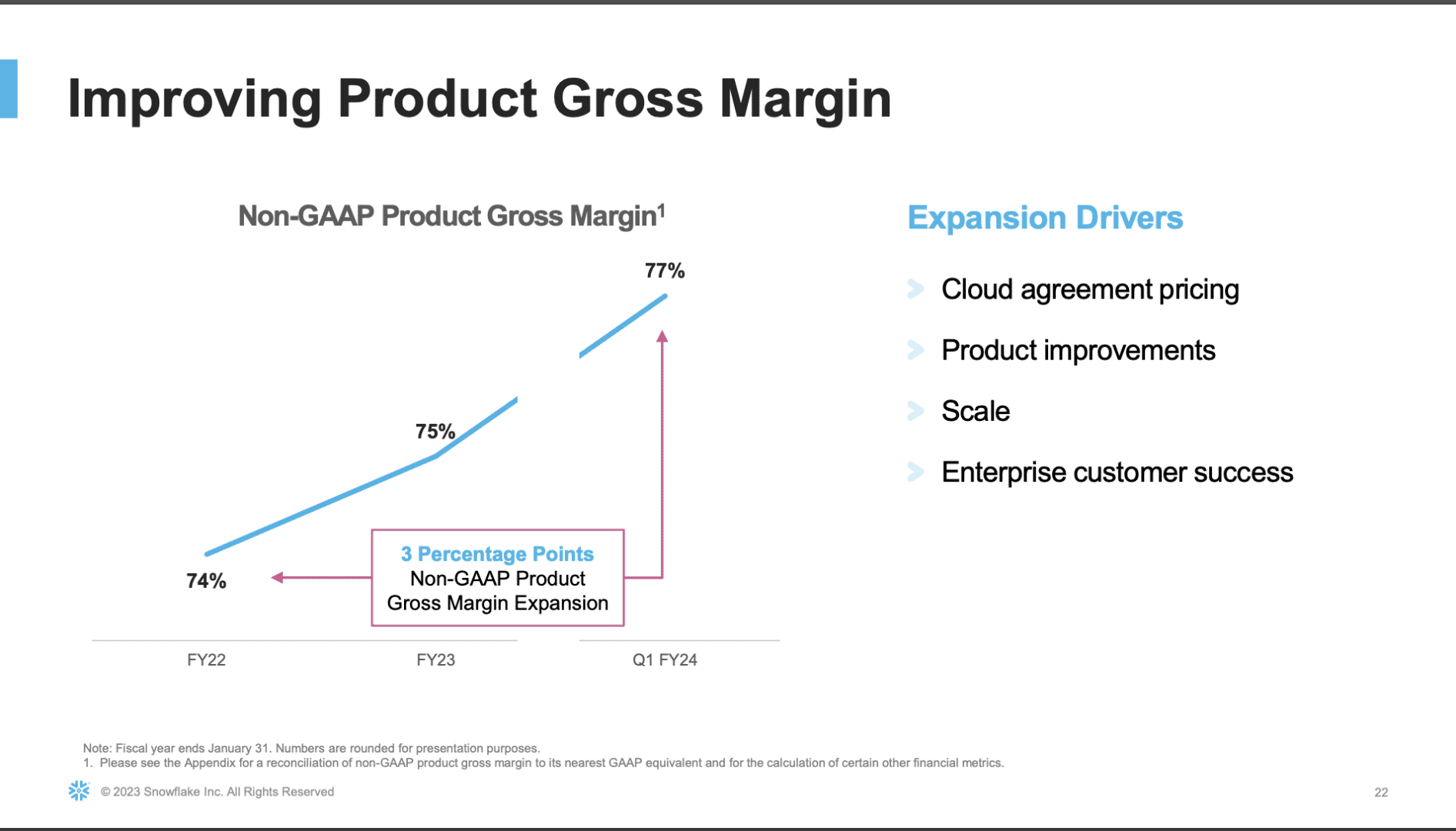

#6. Slow and steady progress on gross margins, now at 77%. I’ve always been impressed with Snowflake’s margins. Given the massive amount of compute and storage involved, I would have expected “less than software” gross margins. But no, gross margins are very impressive, and Snowflake keeps working at it. They plan for 77% gross margins next year, up from 74%.

Wow what a great story, and one we all need to track. Even if you only play at the application layer, Snowflake is what so, so many of us run on. And your customers run on. So seeing what they are seeing is like a magical insight into your customers’ minds — and spend.