- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

So there was a quiet SaaS IPO you may have missed in the craziness of 2021 — SEMRush, a tool your marketing department quite likely uses to keep track of the performance of your SEO and marketing site.

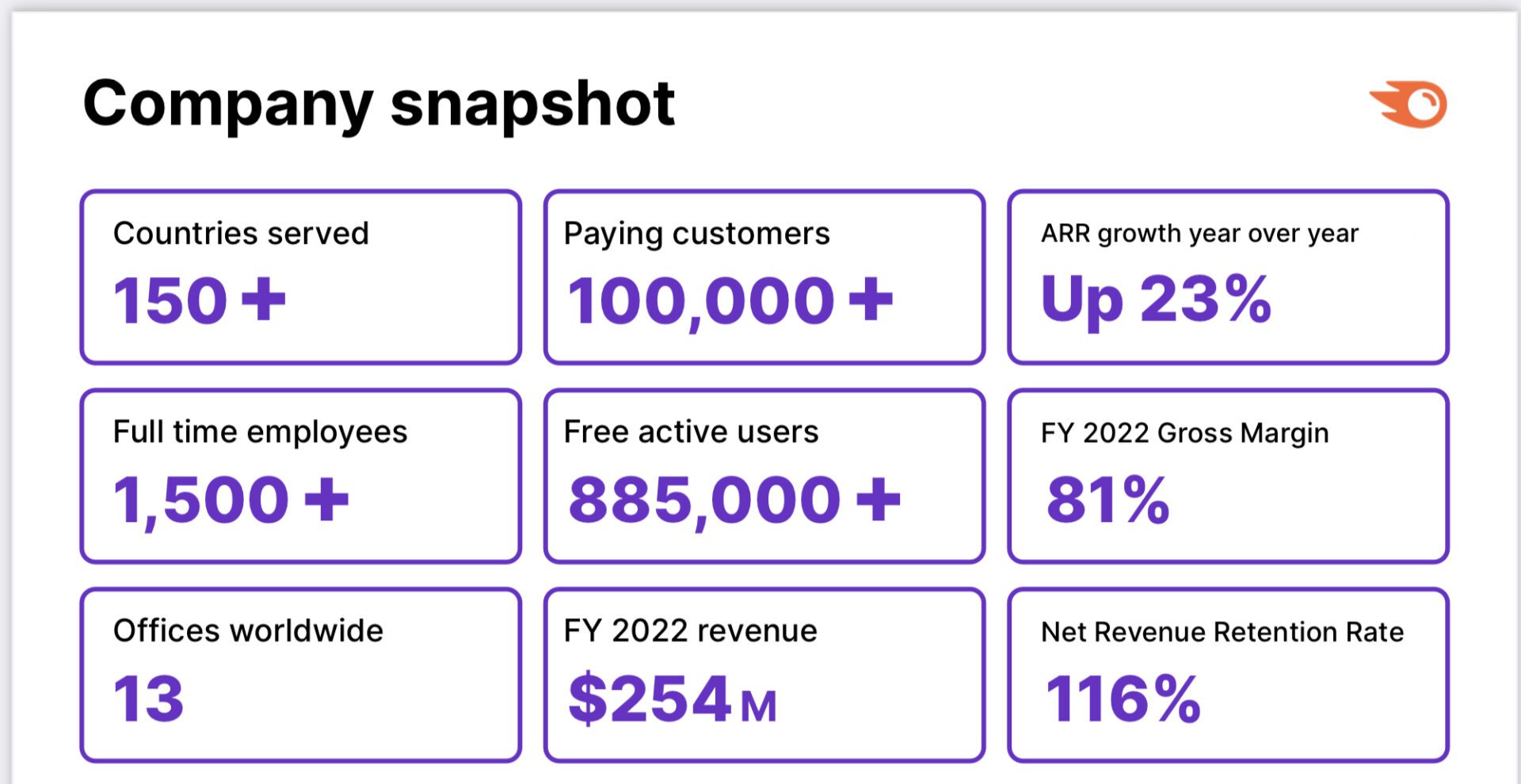

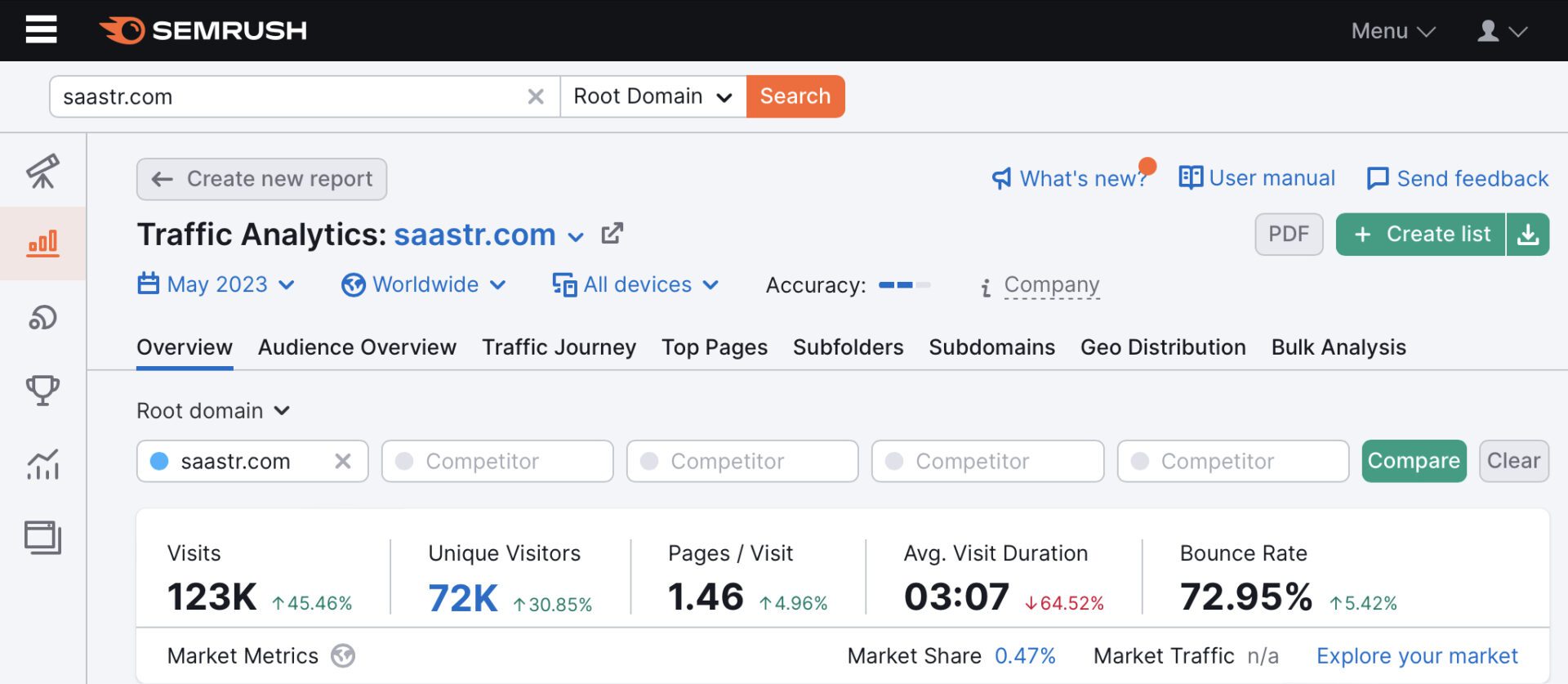

Today, Semrush is quietly doing $290,000,000 in ARR, with strong NRR, and growing a very respectful 24% a year … and is worth just $1.2 Billion. It’s tough out there in the public markets, folks.

5 Interesting Learnings:

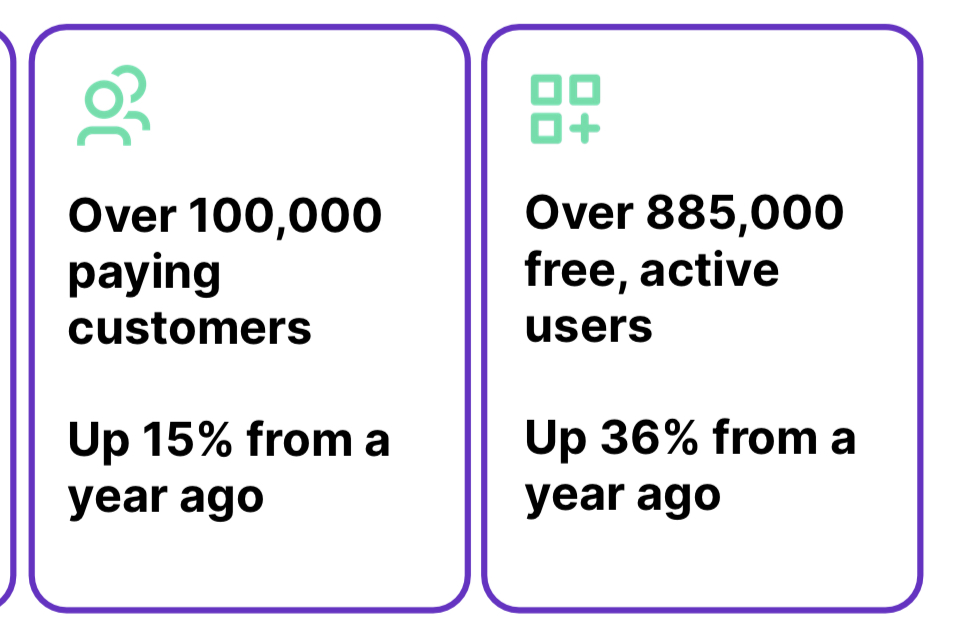

#1. Crossed 100,000+ Paying Customers, So About $2,800 ACV Per Customer. But $10k+ customers growing fastest. The classic “high-end of self-service” price point. But $10k+ customers are growing 45%, so that’s where the biggest growth is.

#2. 885,000 Free Users, so about 12% Convert from Free-to-Paid. This math is never as straightforward as it looks, depending on how valuable the Free edition is, and how aggressive the “choke” from Free to Paid is. Still, always helpful to see how any leader does free to paid at scale. And interesting to see they are growing the top of the funnel, Free, faster than Paid:

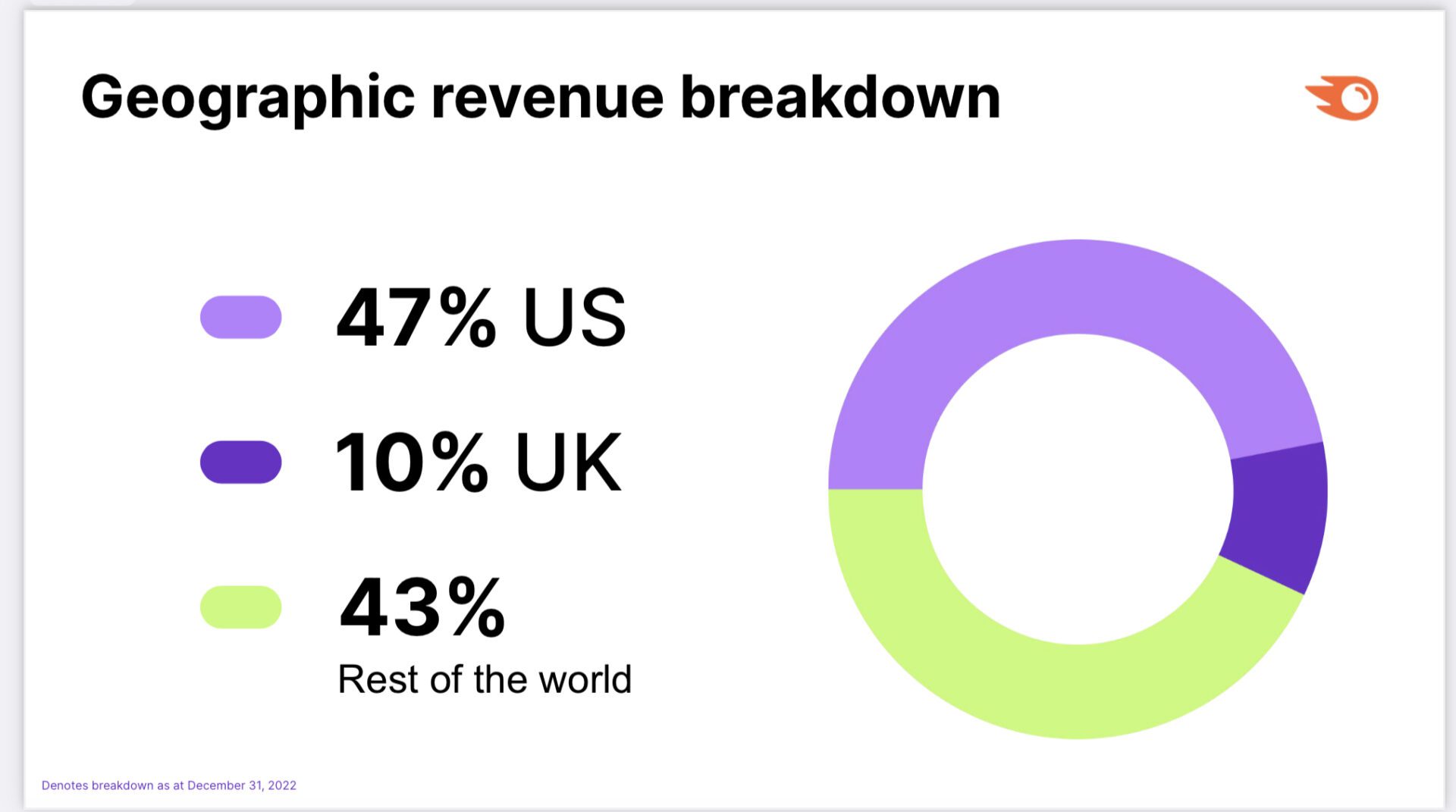

#3. 53% of Revenue is Outside U.S. Not a surprise, and very similar to HubSpot’s ratios here — but always interesting to see. And again a challenge to everyone in SaaS to go global.

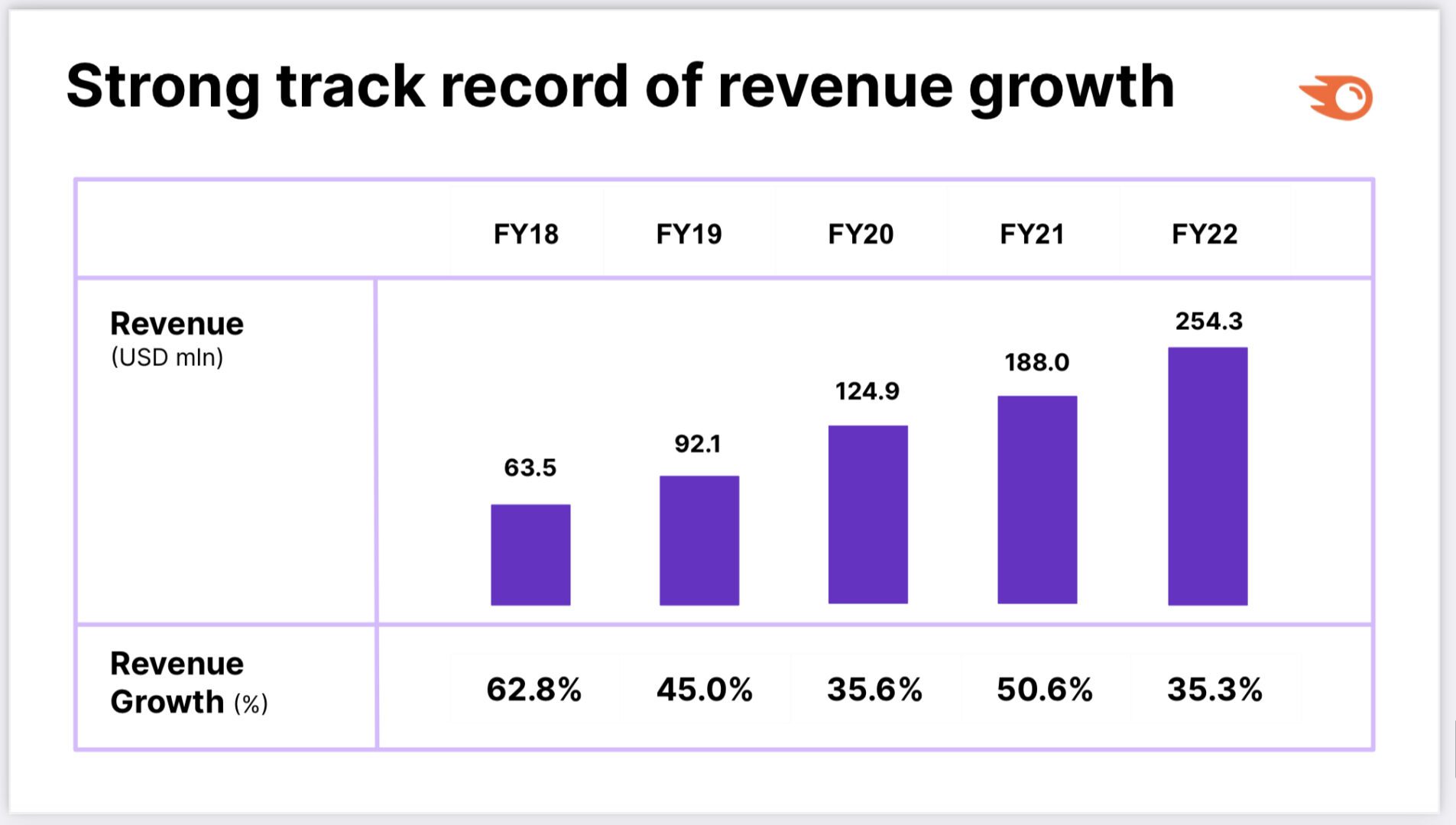

#4. 2022 Growth Was Down from 2021, But Almost the Same as 2020. Growth was 35% in both 2022 and 2020. Another simple example of 2021 being the outlier year. Still, 2023 has started more slowly.

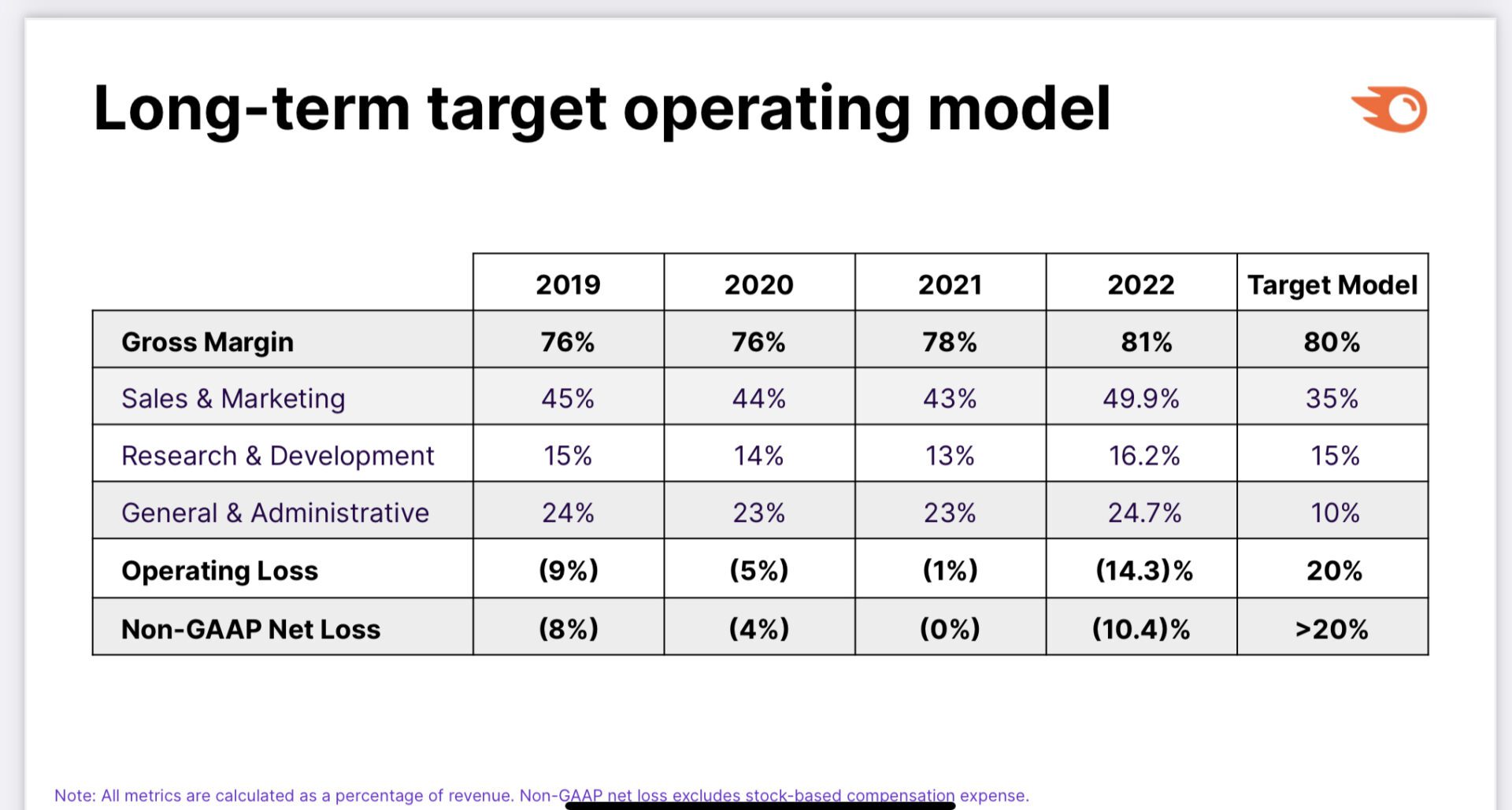

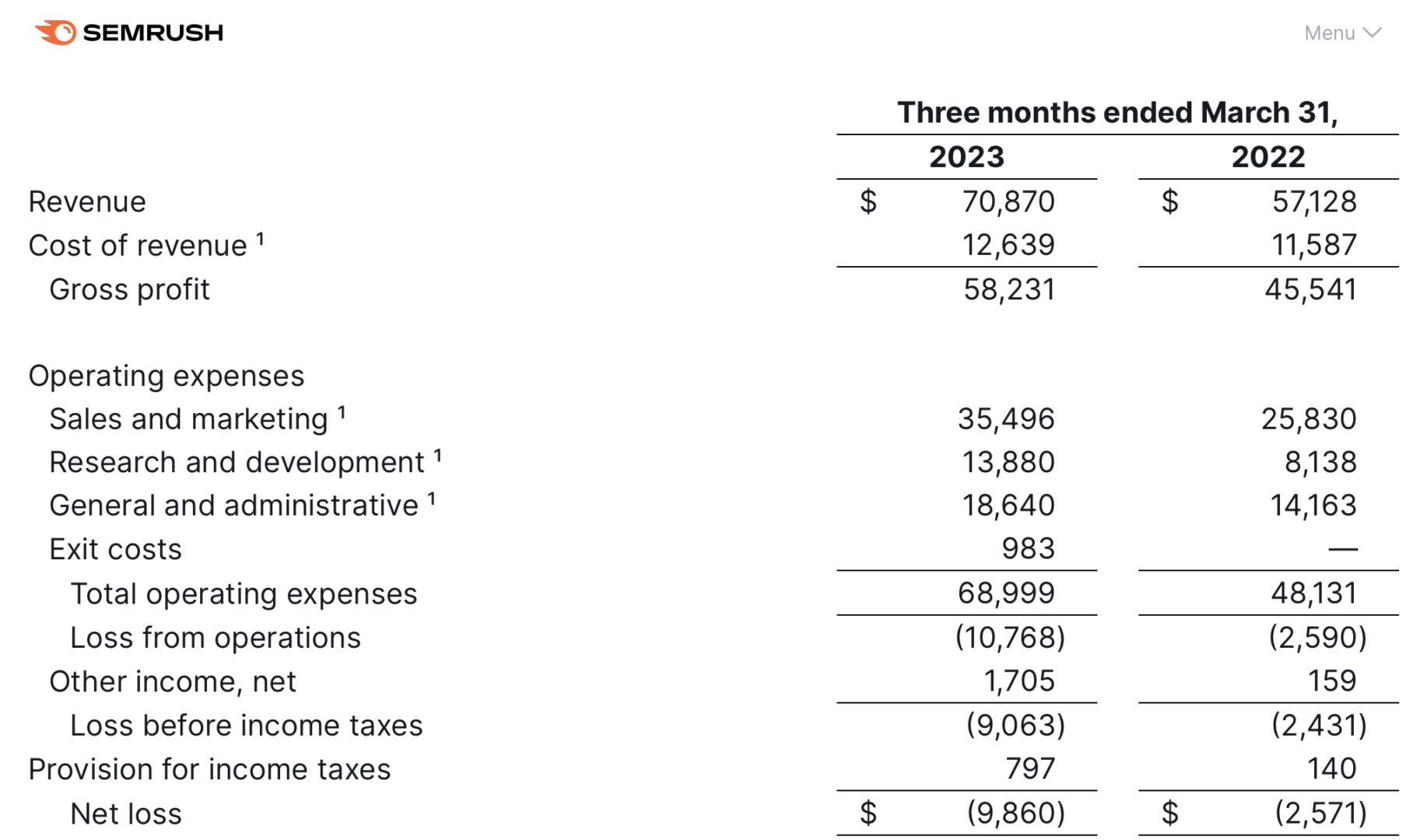

#5. Not Yet Non-GAAP Profitable. This likely explains the modest multiple and market cap. While SEMRush has grown impressively, it’s not highly efficient even at $280,000,000 in ARR. The markets care again about efficiency. With 1,500 employees, SEMRush is at about $190,000 in revenue per employee (1,500 employees). Getting profitable requires getting closer to $300,000 typically.

And a few other interesting learnings:

#6. Solid NRR at 116%, down just a smidge from 118% last quarter. NRR is holding up.

#7. Spending a Hefty 50% of Revenue on Sales and Marketing. PLG and Self-Serve models aren’t always cheaper, and SEMRush is an example. They spend a pretty high 50% of all revenue on sales and marketing — and that’s up from last year. Atlassian by contrast spends just 15% of revenue on sales and marketing, one of the lowest of the public SaaS companies.

A very solid business that continues to perform well even with marketing spend under pressure. A valuation of 4x ARR? Awfully low IMHO for what they’ve built.