- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

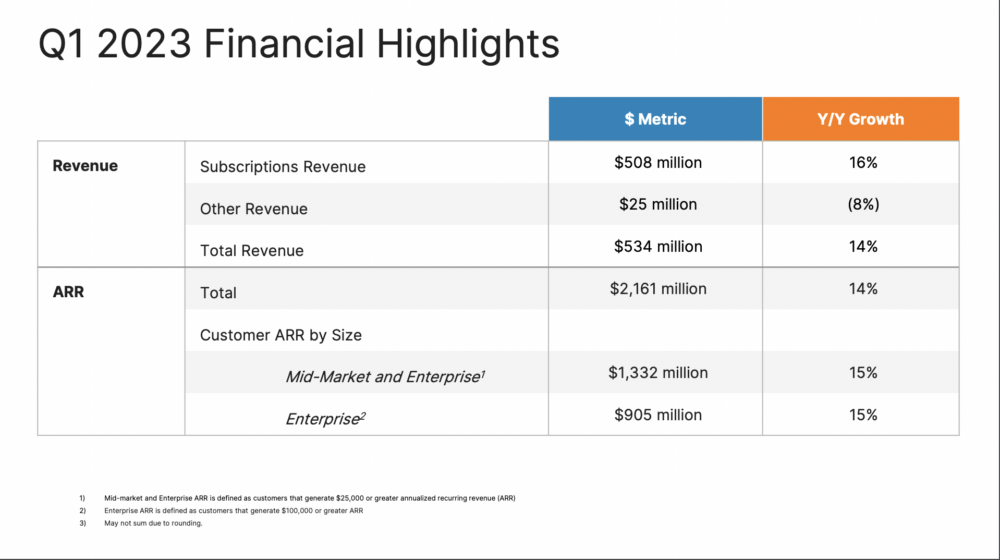

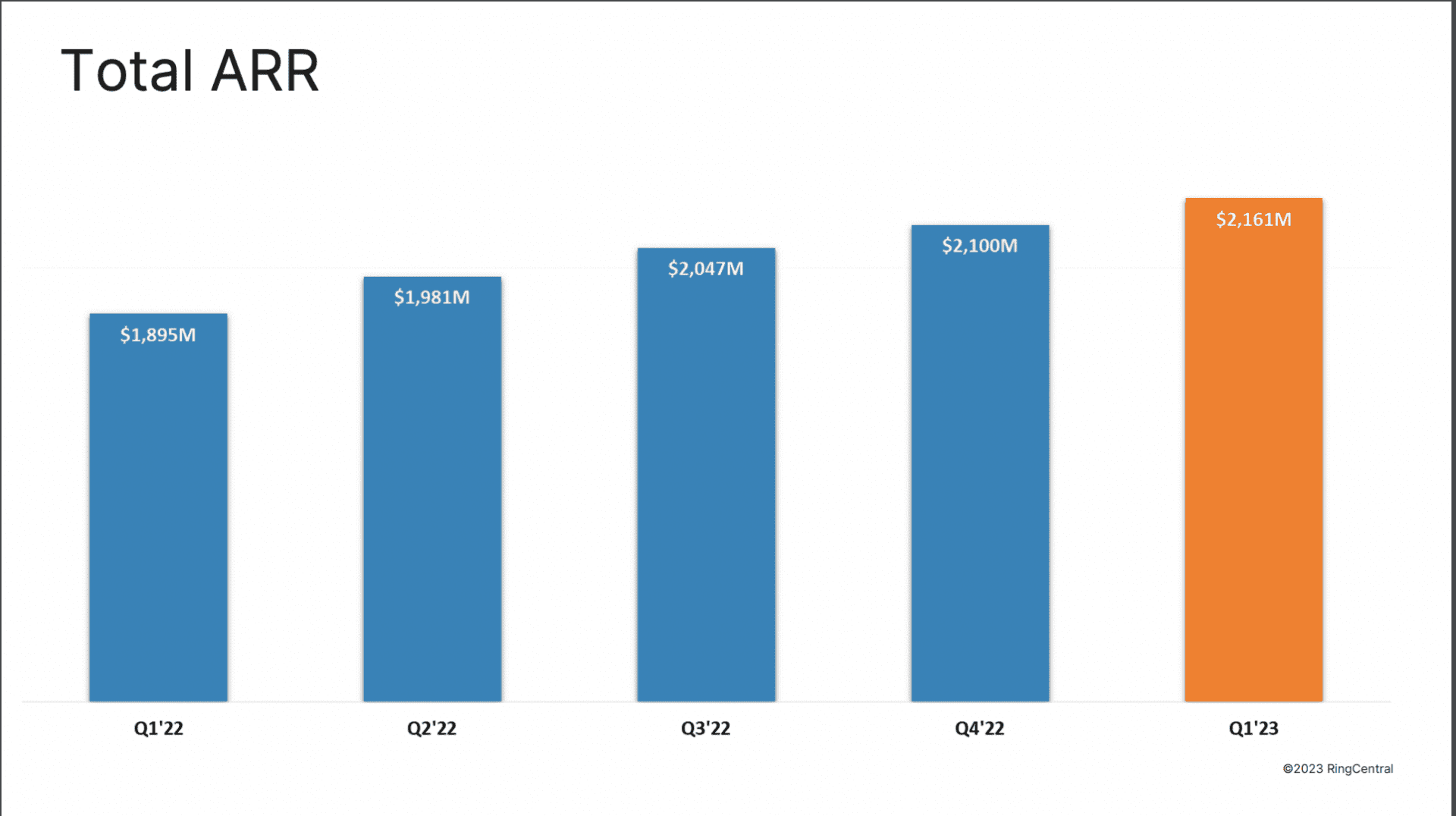

So RingCentral is a quiet SaaS leader that has been around for a long time, since the early days of SaaS. It’s built its way into an enterprise contact center leader and has now crossed $2 Billion in ARR, growing a mature but still steady 16%. And while it’s not GAAP profitable, on a non-GAAP basis, its margins are way up to 17%.

So what’s that worth in 2023?

Sigh. Only $2.8 Billion. RingCentral, with all that momentum and improved efficiency and margins, is only worth 1.3x ARR. Now, RingCentral also carries significant debt, so it trades at more like 2x enterprise value. But that’s still mighty low.

Revenue multiples are brutal out there for many.

RingCentral:

– $2.1 Billion in ARR

– Growing 16%

– Non-GAAP margins of 17% and trending upAnd market cap?

$2.76 Billion

That’s 1.3x ARR folks pic.twitter.com/2UlOfY37KS

— Jason ✨Be Kind✨ Lemkin (@jasonlk) May 11, 2023

5 Interesting Learnings:

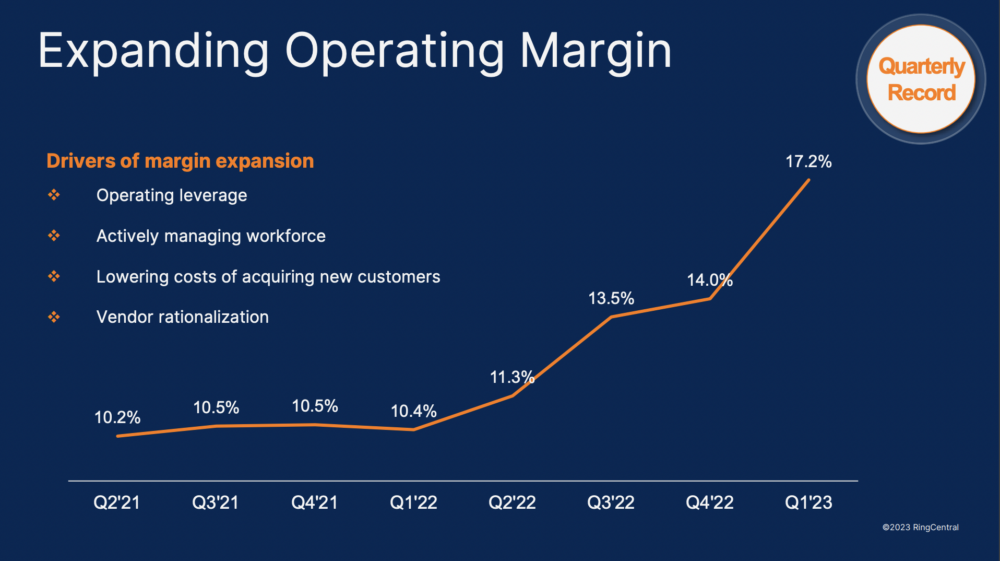

#1. RingCentral has gotten radically more efficient the past 12+ months, growing its non-GAAP operating margins from 10% to 17%. That’s a lot of cost-cutting and management. That’s the theme of 2023 — efficiency. Everyone from HubSpot to FreshWorks and more are just getting a lot more efficient, fast.

#2. Smaller, Medium, and Larger Customers Are All Growing at About the Same Rate. Just an interesting note, when so many other SaaS and Cloud leaders are getting most of their growth in this macro environment from their larger customers. RingCentral really isn’t, as all its customer segments are growing at about the same rate.

#3. Growth halved from 2021. In 2021, RingCentral was growing 33%. Today, 16%. Probably a good proxy for similar apps. Your growth may well be half of what it was at the Peak of 2021.

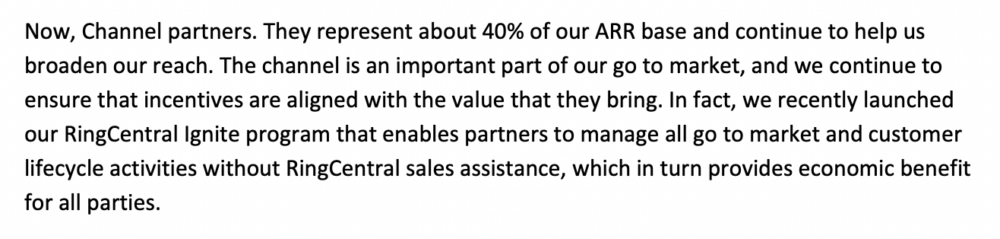

#4. 40% of their Revenue Comes from the Channel (Partners). While this is actually down a smidge from the last few years, it’s still a huge chunk of their bookings and business. A reminder that if your sales are 100% direct, you may be missing a lot of opportunities.

#5. Sales cycles are longer, but leads and win rates aren’t down. This is helpful to learn for all of us. RingCentral is seeing buyer decisions slow down and additional layers of scrutiny, as many of us have. As part of that, upsells are down as well. But leads aren’t down, nor is their win rate. If you still have tons of leads, and your win rate isn’t going down, you’re still well-positioned competitively. It’s important to track all these metrics to truly understand what’s going on if growth is down for you in 2023.

Times are tougher in the call center these days. In 2020, everyone immediately wanted to take their call center to the cloud. In 2023, everything, by contrast, has slowed down. But while the revenue multiple is tough, RingCentral is still growing at $2B+ ARR, with 82% gross margins. Invest in that, even if times are tougher.

![how-to-ask-for-a-promotion-[expert-tips]](https://everythingflex.com/wp-content/uploads/2023/05/9043-how-to-ask-for-a-promotion-expert-tips-150x150.jpg-23keepprotocol)