- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

So Freshworks in another in our line of “hero companies” in SaaS. While Freshworks is very much a global SaaS leader, its history as perhaps the first with deep roots in India to IPO in the U.S. makes it one we all root for as a break-out global leader.

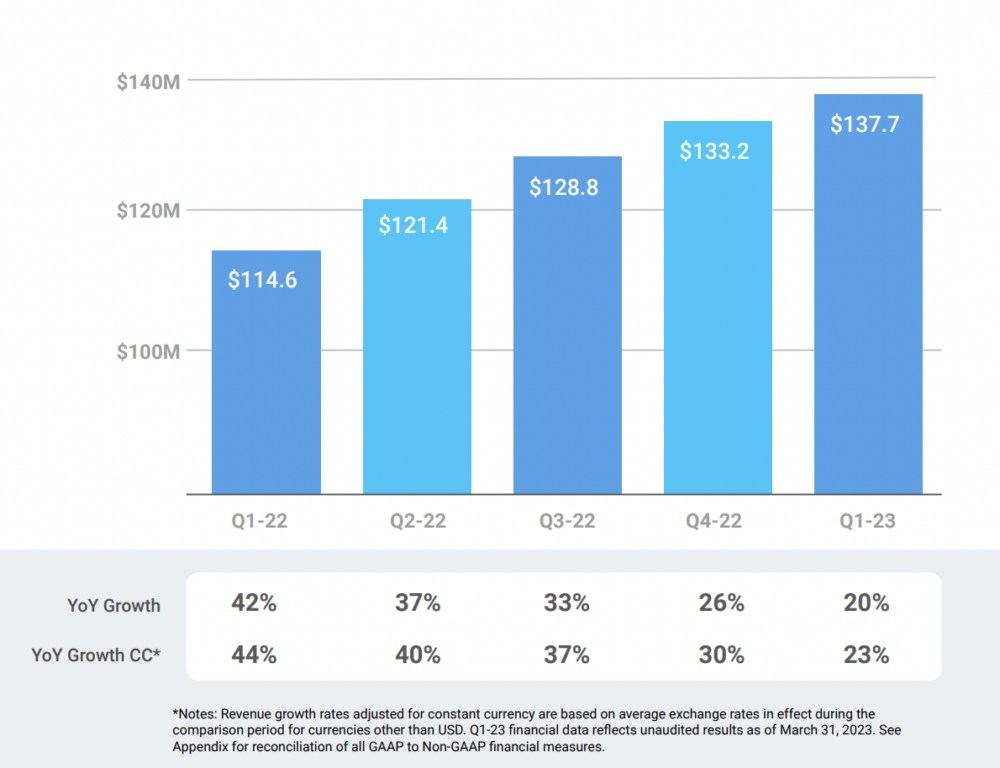

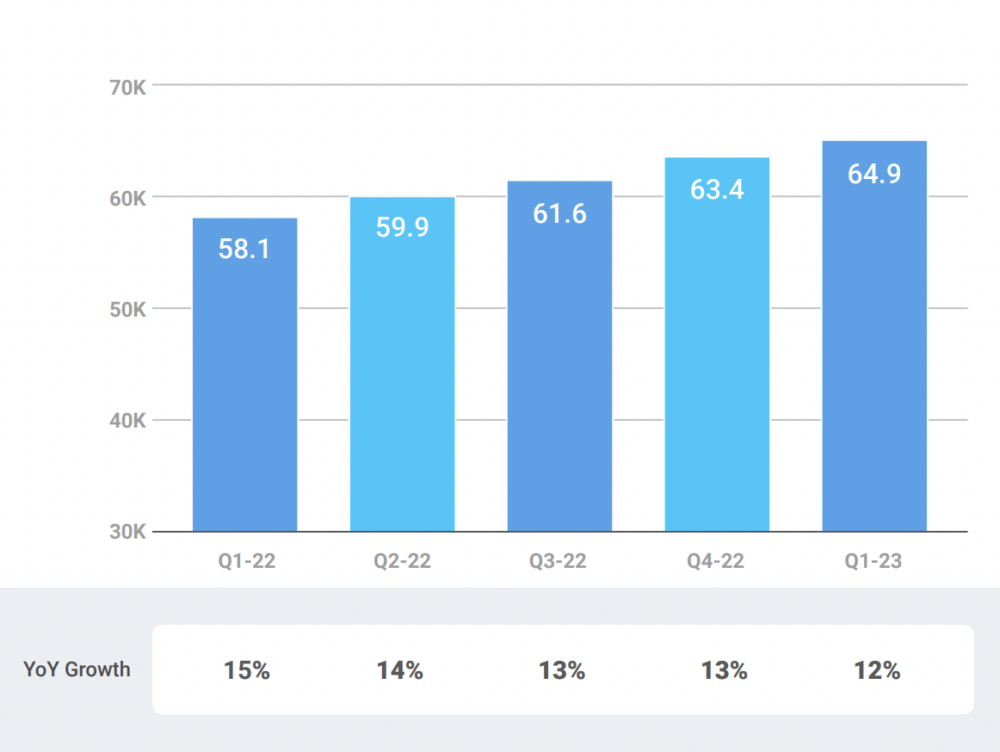

It’s now at $560m in ARR, growing 23% on a constant-currency basis, and while that growth has slowed from the go-go pace of the last 2 years, it still beat Wall Street’s estimates for both revenue and adjusted profit!

Freshworks is doing a lot of things right in a challenging time for many “traditional” B2B segments like CRM, Support, etc. — so a great one to learn from!

5 Interesting Learnings:

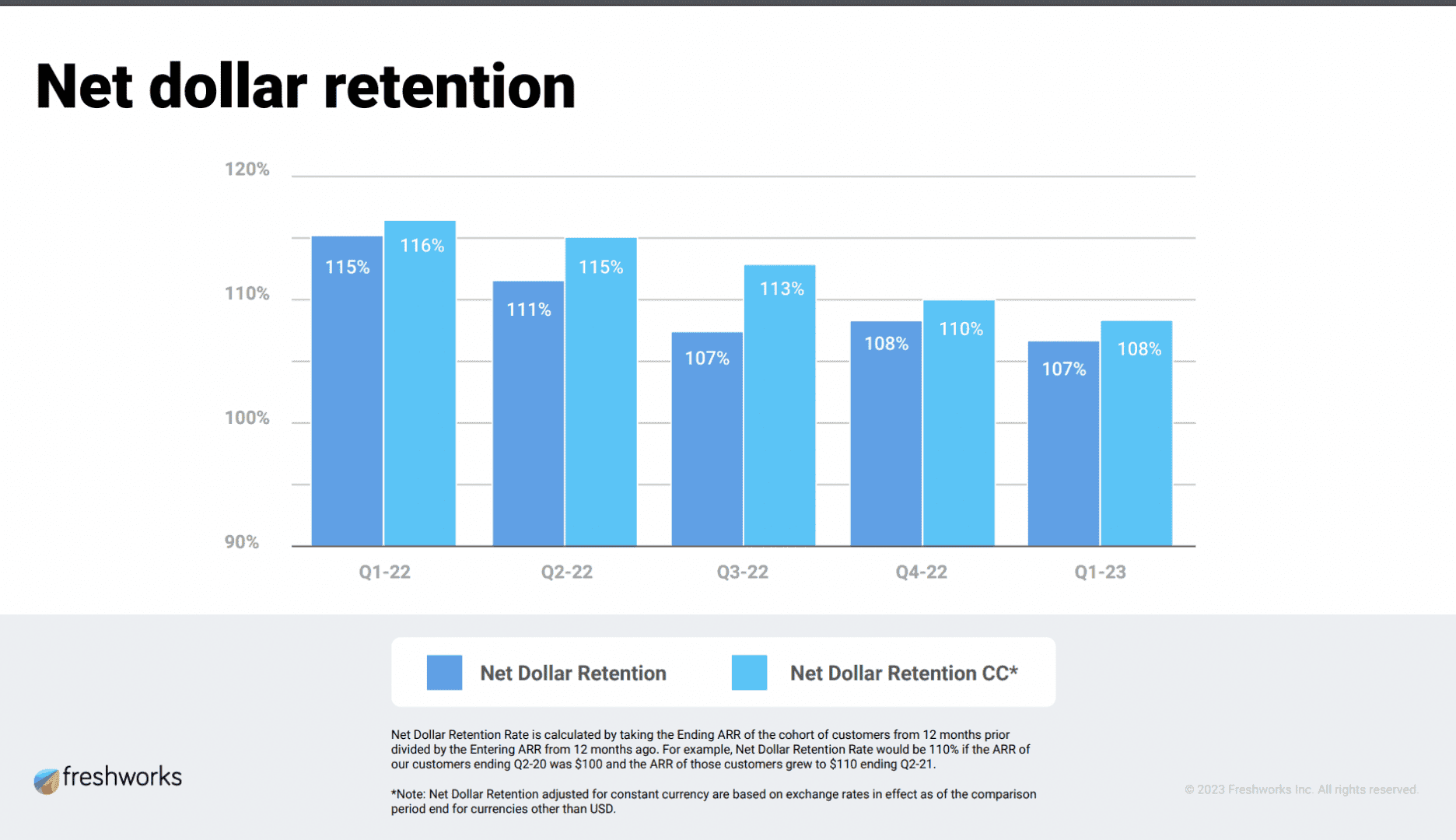

#1. NRR Still Impressive at 107% Given Many SMB Customers, Although Down Year-over-Year from 115%. For those of us who sell to B2B customers small, medium, and larger, it can be super helpful to see what’s happening with a leader like Freshworks. Their NRR remains relatively strong, but ha taken an 8% hit. Probably a fair way to model things in 2023 if you are similar to Freshworks.

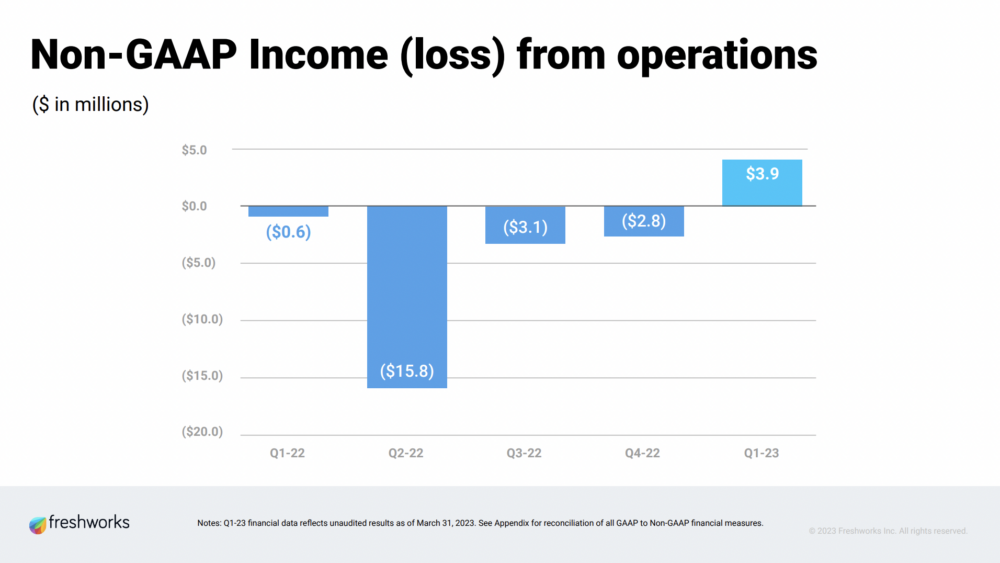

#2. First quarter of non-GAAP operating profit. Freshworks turned “profitable” at least on a non-GAAP basis and hit cash-flow positive in 2022. Yes, this excludes stock-based comp expenses and more, but is still an important milestone. Its burn was modest before, but crossing to both cash-flow positive and non-GAAP operating margin positive is an important step. And a reminder it can take a while in SaaS!

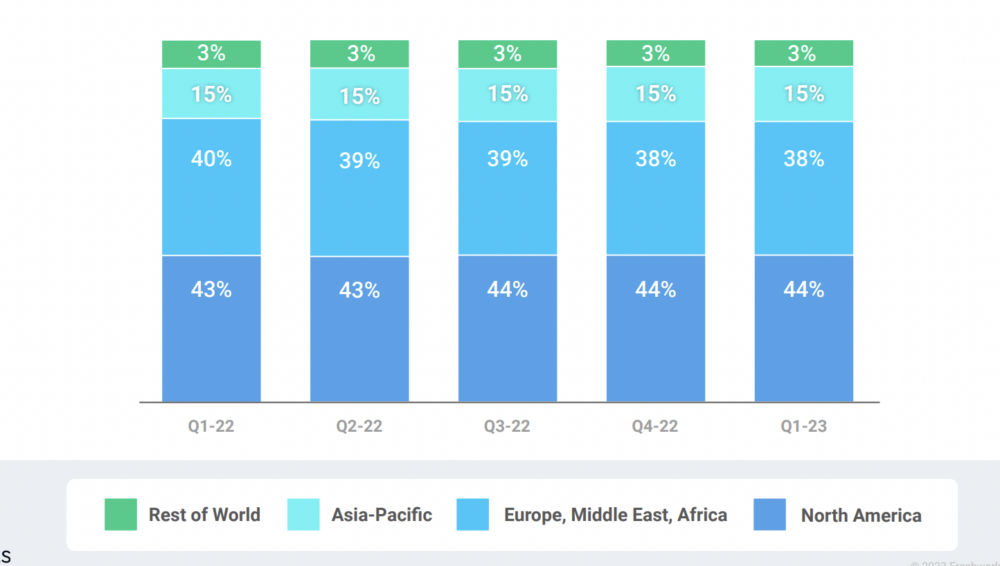

#3. North America continues to be the strongest geography, albeit only by a small margin. EMEA is the weakest, and we’ve seen this for other SaaS leaders as well. While it’s hard in the U.S., it’s harder for many in B2B in Europe.

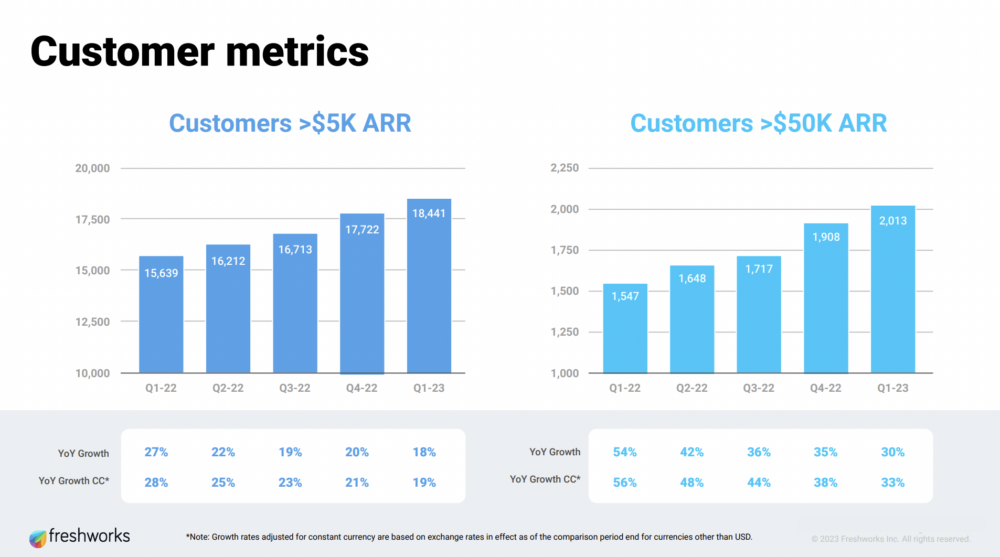

#4. 20% Revenue Growth from 11% Customer Count Growth. I always find it helpful to see this math and ratio. A 2:1 ratio is a pretty healthy ratio as you go upmarket. Much more than 2:1 means you are often relying too much on your existing base.

#5. $50k+ Customers are the Fastest Growing Segment. Another case like Asana and other B2B leaders of slowly going upmarket. $50k+ customers are their fastest-growing segment, at 33% on a constant currency basis. With $5k+ customers growing 19%, that means like Squarespace, Zoom and other leaders, they are seeing the slowest growth in the tiniest customers.

What a great story! And one almost all of us can learn from!