- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Dear SaaStr: What Percentage of Startups That Are Acquired Remain Successful?

It’s all over the place:

- Google bought Android and YouTube and turned them into top core products

- Salesforce grew Mulesoft, ExactTarget, and so far, Slack and all grew well after their acquisitions. In fact, Salesfeorce’s mutiple Clouds today are really built on top of its biggest acqusitions.

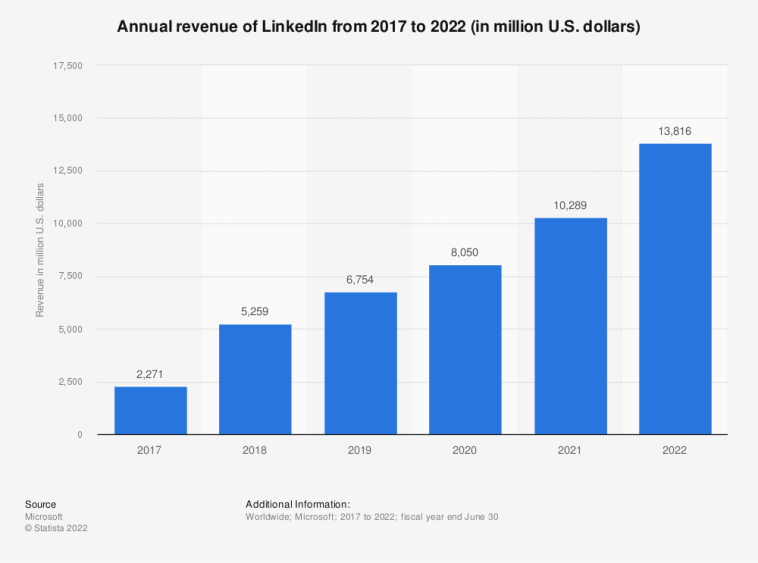

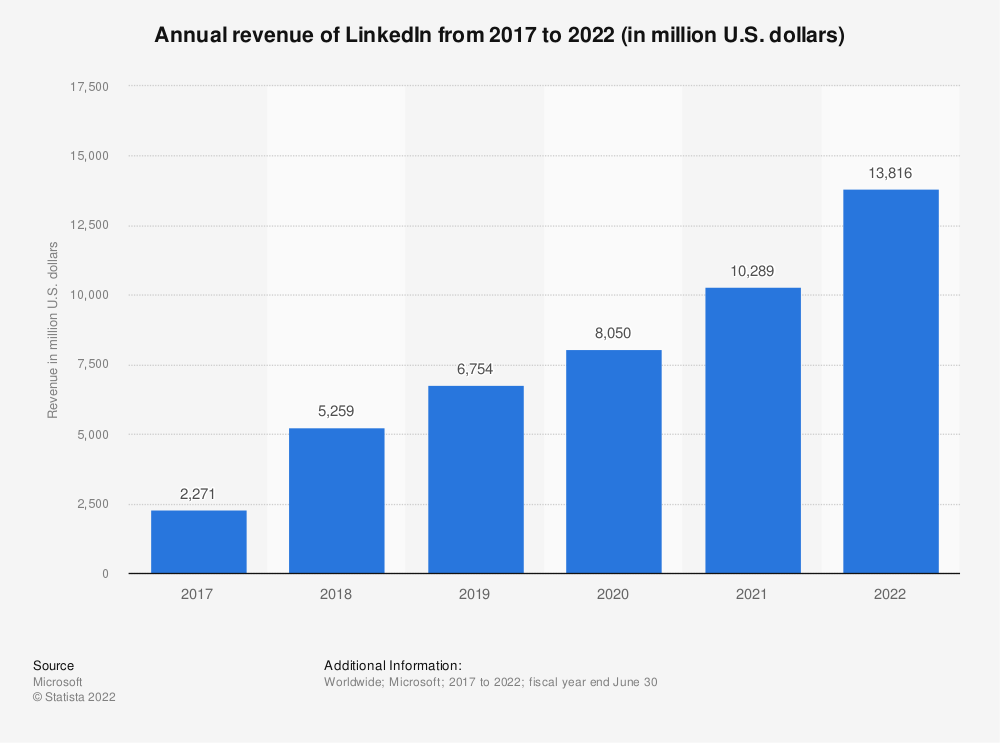

- Microsoft bought LinkedIn, and after a bit of a rough start (a few slow years), it has accelerated and today thrives under Microsoft, having rocketed past $10B in ARR

- ZoomInfo, one of SaaS’s great recent IPOs, is really an acquisition story. The “ZoomInfo” product was an acquisition. More on that here:

It’s tough to know from the outside — but easy to know from the inside.

In my experience, what matters is priorities. If Google, Microsoft, Salesforce, or another giant puts huge effort against an acquisition, and sustains it for 5–10 years … it’s likely to make it. If it’s truly critical to the CEO or a top SVP. They have massive resources, after all, and tons of smart engineers. Even if they have trouble creating brand new products that thrive.

For us, at Adobe Sign / EchoSign, we grew post-acquisition into a product doing hundreds of millions a year in ARR. So we grew impressively. But it wasn’t never quite a top priority. So we never grew as much … as we could have.