- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

There’s a pattern I see again and again, probably with 30% of venture-backed start-ups, maybe 40%. Their burn rate sneaks up on them, and becomes a bit out of control — without feeling like it.

This usually doesn’t happen in the very early days, when you just have a few employees and almost no real marketing or sales expense. But it starts to creep up on you as early as $1m ARR.

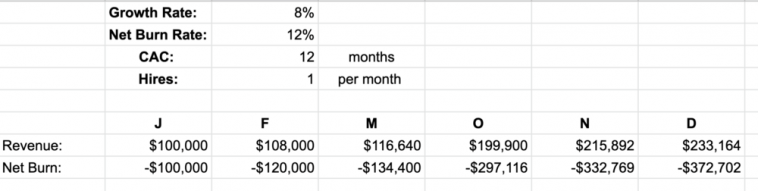

Let’s take this example of a SaaS company doing really well at $100k MRR. It’s growing 8% a month, or growing 2.5x a year. And the net burn rate starts off pretty low — also at $100k a month.

It’s just, to invest in sales and marketing now, and make those extra hires, the burn rate is growing even faster at 12% a month after $100k MRR.

Here’s what happens:

“This won’t happen to us”, you think.

But let’s do a deeper dive and you’ll see how easy it is for your burn rate to compound faster than you realize. In this example above, the startup might be only:

- Hiring 1 extra hire a month after $1m ARR. This sounds about right.

- Is investing in marketing programs with a CAC of ~ 12 months. So customers go profitable in Year 2. This probably makes sense if your churn is low / NRR is 100%+.

- Is just keeping up with demand. The time is now.

And yet each of those elements compound:

- Hires are often a bit more expensive than you modeled.

- Marketing programs with say a 12 month CAC sound great, and are at scale, but if the customers say are paying monthly and you are paying sales commissions upfront, those new customers will consume a fair amount of capital.

- You need some more room to experiment and make mistakes as you scale

- Renewals take a few years to kick in. Once they do, they help with cash flow. But it takes time for them to be material.

In the example above, at the end of the year, the burn rate by the end of the year is $4.5m+ a year, and growing. That’s probably OK if you raised say $15-20m. Maybe even OK if you raised $10m. But if you raised a seed round, you could in real trouble. Even though things other than the burn rate are going well!

My real only point here is you need a Burn Rate Budget. Your gut on how much you are spending, and what is “lean” often breaks after even $1m ARR.

And:

- Make sure you know how much you are spending. So many founders really aren’t 100% sure. Not really.

- Make sure you have someone in finance, even if they are part-time, that can model your burn rate and report on it monthly (or faster). And make sure they have SaaS experience, or they won’t understand how cash flows in a recurring revenue model.

- Make sure your collections are equal to or ahead of your MRR. So many startups that invoice customers get in trouble on collections, and fall too far behind actually get paid. More on that here.

- Make sure — you know. If you take your eye off the ball on cash, you almost always end up spending more than you think you are spending.

And as you can see from the above, highly simplified model — even a slightly elevated burn rate compounds. A high burn rate month is rarely followed by a few lower burn rate ones to balance it out (as many founders intuitively think). Instead, it just grows a bit bigger each month. Unless you are truly managing it.

If nothing else, you just have to know your Zero Cash Date. More on that here. And build a rolling, L4M model to predict it. How to do that here.

![4-easy-steps-to-get-a-custom-email-domain-[+-key-features-to-look-for]](https://everythingflex.com/wp-content/uploads/2021/06/8500-4-easy-steps-to-get-a-custom-email-domain-key-features-to-look-for-150x150.jpg-23keepprotocol)