- Like

- SHARE

- Digg

- Del

- Tumblr

- VKontakte

- Flattr

- Buffer

- Love This

- Save

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- JOIN

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

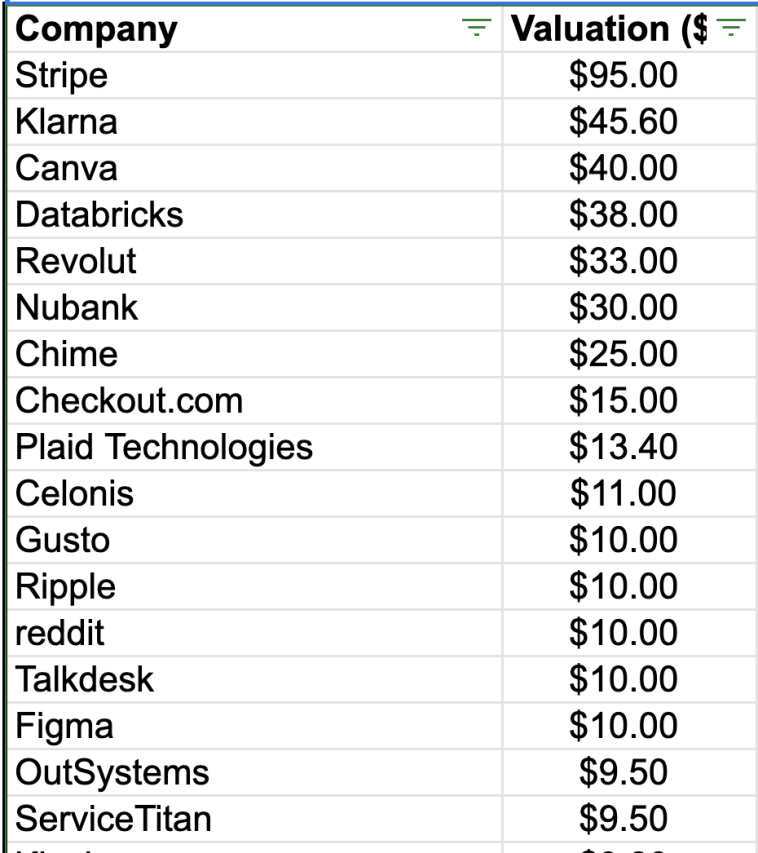

So just how many SaaS, Cloud, B2B/B2D pre-IPO unicorns are there really?

Folks count differently, but I decided to take a slice of CB Insight’s last data — download it here — which shows 903 Unicorns. I took out the B2C, hardware, and non-SaaS healthcare ones, etc. I probably missed a few and included some I shouldn’t have. But I think it’s a directionally correct slice.

So how many of them are like us — SaaS, Cloud software, or fintech that is SaaS-y?

- I count about 337 Unicorns and 15 Decacorns; and

- The “average” unicorns is worth $3.39 billion.

Both, as crazy as it may sound, sound about right.

A lot of the Decacorns and top Unicorns are fintech related, and you might not even call them SaaS/Cloud software. Some fintech is clearly more SaaS-y than others. So you can maybe cut the numbers by 33% or so if you want:

And there are quite a few just below $10B, from Klaviyo and ServiceTitan at $9.5B and more.

In any event, it’s good to have a sense of just how many unicorns there really are in the SaaS and SaaS-adjacent world.

And likely, there are about 3x as many in the wings. And many will IPO in general, and many of those that do will IPO pre-decacorn status, so decacorns may continue to remain fairly rate, despite there being an impressive number of public ones now.

So prediction: at the end of 2022, we’ll have 1000 private SaaS/Cloud Unicorns and 50 private Decacorns

Let’s just check back in then and see.